Covid-19’s effects on Diverse Ethnic Communities: a deeper understanding through co-production

By Caroline Francis, on 23 February 2021

This blog post is part of a new series exploring what UCL Community Engagement work has looked like during the Covid-19 pandemic. This article has been written by Suzy Kirby, Marketing/Communications Lead at Money A+E.

The project was supported with funding from UCL Culture and UCL East as part of Listen and Respond.

Prosperity: How can we define it, measure it, achieve it?

Money A+E and the Institute for Global Prosperity (IGP) were first brought together by a shared interest in exploring these questions in 2018. Since then it has driven a deep collaboration and partnership between our organisations. When Covid-19 posed the biggest challenge to prosperity for several generations, it was natural that that partnership should put its research apparatus into action.

Money A+E provides money advice and education to Diverse Ethnic Communities* (DECs) and disadvantaged groups.We are a social enterprise, operating in many of London’s most deprived boroughs including Newham, Tower Hamlets, and Hackney. Money A+E was born out of our co-founders, Greg and Jerry’s, own experiences with debt. We know that debt almost always co-occurs with other interconnected challenges in an individual’s life – and its most effective solutions are also interconnected. We support others to find them through a combination of expert advice and peer support, and sharing experience within the community as mentors, volunteers, and staff members.

We are always trying to better understand the impact of our services not only on people’s financial health but also on their skills, confidence, and overall wellbeing. Rigorous evaluation of our services makes this possible, and here the brilliant support and expertise of our IGP partnership lead, Dr Chris Harker, and his team have really helped us to develop.

The Institute for Global Prosperity’s multi-disciplinary research explores prosperity as a concept that is about more than wealth, also taking into account – and exploring the connections between – many other processes and experiences like optimism, wellbeing, or a sense of belonging.

Working with IGP has allowed us to develop a standardised methodology for evaluation, which could be digitised when our services moved online. By including Office for National Statistics standards, the IGP team framed our impact in a broader context, in a format understood by the funders, institutional customers and partners who might help us to grow our reach.

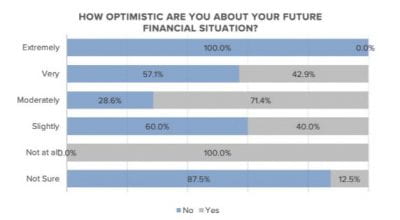

Relationship between future financial outlook and Covid-19-related impacts on housing (where ‘yes’= impact on housing and ‘no’= no impact on housing).

Covid-19

When Covid-19 struck, it hit DECs and deprived London boroughs especially hard. Our one-to-one debt, benefits and money advice service saw a threefold increase in demand. Many of our service users had ‘slipped through the cracks’ of safety nets. Those who were struggling with debts pre-crisis and had little to no savings, were left especially vulnerable to such financial shocks.

As this unfolded ‘on the ground’, lots of excellent research was appearing in the news that laid out the developing health and financial effects of the pandemic. Dr Harker kept in close contact with our team throughout this time, and we agreed that it was an important moment to add to this big data with voices from Money A+E’s own community.

The project

Dr Harker proposed undertaking research through a telephone survey with previous users of Money A+E’s services, conducted by IGP researchers. He drew on our existing evaluation framework to create the survey questions, and provided a draft of these to the Money A+E team for comment. We also attended a planning meeting with the IGP survey team: the research process definitely reflected the ongoing conversation that has characterized our partnership.

It was of course crucial to deepen our understanding of the financial impacts of the pandemic, and the survey asked questions about housing, employment and money. Other questions such as ‘How optimistic are you that your community will recover socially?’ spoke to a broader definition of prosperity in the lives of Money A+E’s service users. Last but not least, the survey was an opportunity to learn about any lasting impact of Money A+E’s services in the context of the pandemic.

The work progressed really well, but as for challenges – there were a few! As a rapid response to lockdown, the project had to be delivered extremely quickly: funding was confirmed on 11 June, researchers were trained on 19 June, and on 22 June, telephone calls began. Research would usually involve a lot more time for reflection, but the IGP team handled things brilliantly.

Outcomes

One of the survey’s most striking findings was that Covid-19 had significantly reduced our community’s ability to safely and comfortably inhabit their homes. 30% of respondents reported not having paid their rent, and nearly one quarter (23%) having services (gas, electricity or internet) turned off during lockdown. This was significantly higher than the national average of one in nine (11%) reported to have fallen behind on bills. It also affected levels of optimism about the future.

As a direct result of these figures, Money A+E’s focus has shifted towards providing more support around housing. The findings also showed that money management skills had a positive impact on respondents’ lives during the lockdown, with 60% saying that Money A+E’s advice and education had helped their financial situation. This was more than just a pleasant surprise for us: it underlined the lasting value of providing accessible, community-led money support to DECs.

This project has been supported by funding from Listen and Respond, an rapid response funding scheme to support UCL staff work collaboratively with the voluntary community sector in London to respond to the needs of communities as they confront and recover from COVID19.

Close

Close