Tsagaan Sar Gift Index — 2016

By ucsaar0, on 8 March 2016

Members of the Emerging Subjects project at UCL and the National University of Mongolia contributed to this post.

What does focusing on gifts given and received during Tsagaan Sar tell us about the general economy? Last year we posted our first Tsagaan Sar Gift Index (TSGI) and found that the slowing economy shaped how people celebrated the holiday, with people confining the celebrations to fewer days and opting for more useful gifts (like socks) that support Mongolian businesses.

This year, the economy has been shaken further with pressures of increasing public and private debt and the slowdown of commodity prices globally. We found that people bought less over-all in preparation for Tsagaan Sar. While prices have decreased (especially the price of meat), the cost of this year’s celebration was very straining. This was especially true for those without a regular income, or dependent on the sale of meat for money. The cost of preparing and sourcing goods was compounded by an already difficult time economically, and many pensioners used their pensions to take out loans, or purchased items through credit to fund the celebration.[1]

Based on comparison of our different cases, it seems typical for a lower-income household to spend less than 600,000 tögrög; a middle-income household to spend between 600,000-800,000 tögrög; and high-income over one million tögrög. If a household has elders or highly-respected individuals, such as a doctor or singer, they often have to spend well over one million to accommodate the large number of guests. Though households might receive a good amount of money in the form of cash gifts given by guests (around 100,000-400,000), this does not seem likely to off-set the cost of items like vodka, prime cuts of sheep meat, gifts for guests, and holiday outfits that are purchased in advance of the holiday.

Average Tsagaan Sar expenditures based on age group. Courtesy of Mongolian Marketing Consultancy Group.

Alongside our reflections we have interspersed the text with statistics from the Mongolian Marketing Consultancy Group’s survey on people’s attitudes toward Tsagaan Sar (with kind permission from Bumerdene Dulam). Although these are based on very general reflections, they complement the individual experiences we recount. They also reveal rising public interest in the high cost of the holiday.

Preparations

Based on her ongoing work with traders at Narantuul market, Hedwig noted that the market was, as usual, packed in the lead-up to the National holiday, and especially so in the last three days of the previous lunar year. The sellers were happy to be busy, but many remarked that over-all spending was much less than usual, and was characterized by ‘scattered’ and ‘irregular’ purchases (таaруу). In fact, the average trader made 30% less than last year selling goods for the national holiday

Those who sold household goods (ariun tsevriin hereglel) encountered a decrease in comparison to last year in spending of around 10 %, as people bought gifts like shampoo and soap from their shops, as well as products to clean their homes before the celebration started. Clothing shop traders (i.e. non ‘necessary’ goods) reported a loss in profits of between 30-50 % compared to previous years. Instead of purchasing new clothes, many reported using old material to make their New Year outfits, or simply reusing what they had. Others reported re-gifting items they had received, while also being strategic about whom they visited.

One of Rebekah’s friends stressed that:

‘Like all Mongolian holidays, Tsagaan Sar will not be skipped or overlooked. People are spending as much as they can to have a decent Lunar New Year. This year is the year of the Monkey, a year that bears the title of the “mischievous faced-one”. A mid-ranking family can expect to spend from 500,000 – 1,500,000 MNT, with food, drinks, gifts and cash tokens all included.’

According to him, the prices of things were not that high, compared to last year. Instead, he explained:

‘The value of the tögrög dropped to a level where prices do seem high and people’s wallets are thinner this year. One US dollar now is trading at 2005-2010 tögrög in the commercial banks. Experts warn that it could reach 2200 if proper measurements are not taken.’

Many spoke of giving smaller gifts, such as phone credits, 500-1000 tögrög in cash, or small sweets and treats for younger people. Another of Rebekah’s friends reported a disconnect between the generations as to how best to celebrate the occasion, with one person commenting:

‘I see young people wanting to celebrate in a simpler way with less gifts and less extra expenditures; however, elders wish to celebrate it as they used to, so many are in trouble [financially]. 70% of all retired elders are in debt by taking out their monthly pensions in advance.’

Another person described how one of her relative’s took out her monthly pension allowance in advance with her husband. ‘They took out all their monthly pensions until February 2017, and [they] still don’t have enough money to celebrate Tsagaan Sar,’ causing them to ask their family for more money. It is clear that while many are already in debt, they allowed themselves to get further into debt in order to celebrate the occasion in a way they had been used to before.

45% of people take out loans for Tsagaan Sar. 73% obtain a loan from the bank, and 24% obtain a loan from individuals. Courtesy of Mongolian Marketing Consultancy Group.

One member of our research group was in charge of arranging Tsagaan Sar for her elderly grandmother, given that her mother and other older relatives were abroad during the holiday. She was given a budget of 1 million tögrög ($490) to procure necessary food items and 100,000 tögrög ($49) broken into crisp, new 5,000 tögrög bills to give upon guests’ departure.

She was able to spend just under 1 million tögrög to purchase foodstuffs like meat, vegetables, pickles, eggs, mayonnaise, traditional dairy products, fruits, candies, ul boov (large foot-shaped cookies for an offering plate), wine, vodka, and juices. She was able to save some money because she was directed to only serve ‘dal durvun undur’ – the long four ribs of sheep – on the table, instead of purchasing the expensive sheep back and fatty tail. Many other people we talked with also remarked that they excluded this cut of the sheep, due to its expense.

Different types of meat offerings purchased for the holiday. 50% of households interviewed serve the fatty tail of the sheep, the most expensive cut.

Gift-giving

In terms of gifts, the researcher in charge of arranging her grandmother’s Tsagaan Sar prepared boxes of Merci-brand chocolates as well as candies, cough drops, and travel-sized lotions that her mother shipped to Mongolia from the United States. For special guests, like the doctor treating her grandmother, she gave a bottle of high-end Mongolian vodka (Soyombo brand) and large boxed Merci chocolates. Guests greeted her grandmother with brand new currency notes in the largest denominations. In total, she received 150,000 tögrög ($73).

Another family associated with our research group, based in the countryside, roughly budgeted the amount of money they anticipated spending on gifts and food in preparation for Tsagaan Sar:

Anticipated Tsagaan Sar expenses for a household in rural Mongolia. Gifts make up a large part of the budget. Courtesy of G. Munkherdene.

A friend of Lauren’s, who participated in last year’s TSGI, shared that he is still most appreciative of the Mongolian-made gifts that he received. In particular, he really liked receiving a shirt made by the Mongolian company, Oulen (see image below). He was not particularly pleased, however, about receiving Russian-made gifts. One of the more interesting gifts that he received was a set of bowls made by the Russian-Mongolian ‘Ulaanbaatar Railway’ painted with socialist-era themed images. He explained that the bowls used to be in many homes in Ulaanbaatar in the 1990s, thus they have a nostalgic appeal.

Like others we have spoken to, this man chose to visit fewer families than in past years, and also chose to only greet elderly people with money gifts. According to his observations, other people appeared to be doing the same.

Hedwig encountered further forms of strategizing to avoid paying for lavish gifts. For example, many younger people avoided visiting extended elder relatives in order to avoid having to give money. And while some found the cost of giving gifts straining, forms of conspicuous consumption were also prevalent. For example, while many said that they prefered gifts made-in-Mongolia, gifts from other countries were given as a form of status. One household that Hedwig visited, for instance, gave honey and tupperware and facemasks from South Korea, and another gifted British-made shampoo and shower gel. While made-in-Mongolia socks were prevalent gifts, many people commented that the gifts should be ‘useful’ (kheregtseetei / tokhiromjtoi), including objects like cup sets and gloves.

One research team member was surprised when she visited a well-to-do household serving non-traditional food offerings, such as egg-fried rice, fried mushrooms, and glass noodles with vegetables. She found it to be a nice break from the traditional offering of Russian potato salad and dumplings. When she left that household, she was given a gift bag of French-brand cosmetics, a luxurious gift that she heard other people received from wealthy families (other gifts of this nature include cashmere clothes and bed linens).

Most challenging expenses for Tsagaan Sar. 54% report gifts for guests, followed by the fatty tail of the sheep. Courtesy of Mongolian Marketing Consultancy Group.

Another of Lauren’s friends, a man 34 years of age in Ulaanbaatar who has a low salary in state-run office, multiple-side businesses, and a high mortgage that he can barely pay, reflected that he could not afford to visit many families this year and that many people are trying to take out bank loans to finance the situation. More ‘traditional’ forms of celebrating have been promoted, resulting in more conservative festivities, as a direct reflection of the economic downturn.

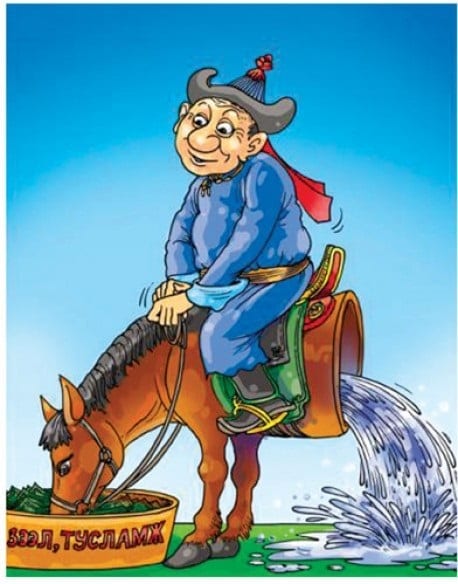

Indeed, the economic strain of this year’s celebration even prompted one man in Dalanzadgad, Omnogobi to write on their facebook profile: ‘Because of the financial crisis this year, [we will] make mantuun buuz for Tsagaan Sar.’ Unlike regular Tsagaan Sar dumplings, mantuun buuz are made with yeasted dough and usually contain less meat filling, thereby providing a less expensive way to fill-up the stomachs of guests. While his comment was made in jest as a form of social critique, it suggests public concern about the affordability of the holiday in the current economic climate.

Comparisons to Past Years

One member of our research group heard from friends and family that this year’s Tsagaan Sar was particularly tiring for people, not just because of the economic situation. This year Tsagaan Sar fell on a Tuesday, meaning that people ended up taking almost the entire week off from work. This meant that Tsagaan Sar lasted not just three days, as typical, but six days (Tuesday-Sunday). For the first time, some families ‘ran out of buuz’ because they had so many visitors, and had to make trips to the shops to restock food items to offer guests, like juice and soda.

Many spoke of the great financial burden of the holiday this year with one friend from Hovd exclaiming, just after Tsagaan Sar:

‘We celebrated the Lunar New Year and worshipped well. No one had adequate cash to buy the things that were needed, so we got items through a bank loan, and through credit from stores.’

Tsagaan Sar seems to be a big financial burden for the elderly. The older you get the more people you receive to your home. The more prestige you are granted, the more of a financial burden you have to shoulder.

The kinds of gifts a family gives are also indicative of its economic standing and networks, and the kinds of gifts you are given indicate your closeness or distance to a particular family member.

The fact that some families can afford to engage in these displays of wealth while others cannot is well-recognized and perhaps epitomized in the phrase: ‘if you are rich in something, offer it to others’ (yougaar bayan tüügeeree dail). Perhaps this holiday was as much about displaying wealth as it was about distributing wealth and sharing resources across generations and groups of friends.

[1] For other statistics and excellent diagrams, see the Mongolian Marketing & Consulting group and their facebook site.

Close

Close