The Politics of the Mortgage Market in Mongolia

By ucsadul, on 29 January 2016

This is the third blog post in a series about debt and loans.

In the beginning of December 2015, news headlines declared that commercial banks would stop providing housing mortgages at a favourable 8 % interest rate. The “8 % interest housing mortgage” (8 huviin oron suutsny zeel) is a nation-wide programme initiated and implemented by the government through commercial banks. The government started the programme in 2013 as a means to increase the affordability and accessibility of apartments for urban residents, particularly young families and those living in the ger districts. The news of the repeal was shocking for many because it froze people’s ability to acquire apartments while also signalling a wider crisis in the national financial system.

Social demand for housing

A friend of mine, B, was planning to sell his flat to his friend in order to buy a larger flat from a different friend. The friend who was planning to buy B’s flat was about to receive a bank-approved mortgage. Because he was very certain to get a loan from the bank, and since the selling and buying arrangements were between friends, they decided to exchange apartments before getting all the paperwork finalised. B moved into his friend’s flat while his friend who had the mortgage approved moved into his former flat. A few days afterwards they all heard the news that banks would no longer be offering mortgages with 8% interest rates. All of them went into a panic and they sought advice from friend who works in the banking industry to find out whether the repeal was a temporary or a permanent policy decision. They asked two friends, one working in the Khan Bank and another working in the State Bank (Toriin Bank), and both assured based on internal bank information that the repeal would not last long.

There is a widespread belief that mortgages allow people who live in ger districts to purchase apartments with low-interest loans, thereby decreasing air pollution in the whole city. However, this does not seem to be the main trigger. The economist Batsuuri, for example, has claimed that people living in ger areas are not the major purchasers of apartments. So while such programmes appear to address social problems, they are also a business opportunity for others.

Monopoly of mortgage market

According to the employee at the State Bank, the bank is the most important, largest, and dominant bank constituting part of Mongolia’s financial system. There are no other major institutions that compete with banks in the whole financial system in Mongolia. Moreover, in the bank, the major financial activity is mortgage loans. According to him, banks cannot function without mortgages. Consequently, stopping the 8% mortgage program might further cause collapse in the ‘financial system’ (sankhuugiin togtoltsoo), because people would not be able to afford to purchase apartments at higher interest rates. Not only him, but many other professionals working in Mongolian banks were very certain that the repeal would not last long for the sake of the sustainability of the financial system.

As I am not an expert on banking and financial systems, I am not in a position to comment in detail here. However this repeal creates an impression that commercial banks profit from mortgage loans and are protected by the existing financial system and high social demand for housing. It is in fact a consequence of the capitalist system brought up in Mongolia since the 1990s that exploits debtors and protect creditors. Bank monopoly was one of the two major arguments the constitution court developed and it became a trigger for the association of banks to decide to repeal the 8% mortgage loan scheme.

In fact the repeal of the 8% mortgage was not an immediate decision. Before it was publicly revealed in the news there was a discussion that occurred in the constitutional court. Civilians D. Yanjinkhorloo and B. Enkhbayar made complaints against some articles in the law regarding bank and non-bank financial service centres (NBFS) mortgage agreements. The complaints address how contracts based on the existing law regulates real estate (flat, house and land) mortgage does not permit civilians to go to court in the case when they are not able to pay loans and dispossesses mortgage property without having judicial decision.

The constitutional court discussed the case, concluding that some articles in the law of real estate mortgage violated a clause in the constitution regarding rights to possess real estate. According to the constitution, any cases of dispossession of real estate property should go through a court decision. Therefore, the constitutional court meeting announced that the law of real estate mortgage violates basic human rights, as declared in the constitution. The constitutional court asked parliament to amend the law and fix the violation. This decision was made on the 9th of December. It required the Association of Commercial Banks to react quickly, indefinitely stopping such mortgages. The constitutional court also raised other issues why the law around mortgages needed to be amended. The court considered that bank and NBFS loans and mortgages violated articles in the law against unfair competition. 17 commercial banks and NBFS dominate loan and mortgage services in Mongolia, by occupying more than the 1/3rd of the mortgage market. According to the law against unfair competition, article 5.1., defines any case of sales and services of more than 1/3rd of the market to be dominating it and, therefore, should be stopped.

For example, commercial banks gain profit from the interest gained on mortgages. As MP S. Ganbaatar puts it in his numerous public talks and parliament speeches: ‘dogs get fat when zud comes’ (zud bolohod nohoi zoolno), – i.e. dogs get fat when there has been a severely cold winter from feeding on the carcasses of dead livestock. This alludes to the profits banks are making when normal people are suffering, and is a reason why he comments that all banks should be called ‘pawn shops’ (lombard).[1] It is indeed noticeable that many Mongolian and foreign business people, including some politicians, have opened banks or NBFS in Mongolia.

Political immunity of mortgage business

The above-mentioned friend who works in a bank further explained that a well-known national company, Bodi International, owns a certain percentage of shares of Golomt Bank. Lu. Bold who is the founder and owner of this company is also an MP and a minister. A news article from 2010 revealed some of the owners of this bank, but many are not known.

The banker further revealed that a very large national company, the Tavan Bogd Group, and other foreign companies, such as ‘Savada Holdings’ from Japan, are owners of the Khan Bank (the latter owns the largest portion at 53%). Another article from 2014 refers to bank owners as usurers (mongo huulegchi). The same term was used in the early 20th century to identify Chinese and Manchu high-interest money-lenders. The article reveals that ‘Global Investment and Development’ owns the largest share of 65 % of the Trade and Development Bank. The article speculates that the ex-President N. Enkhbayar and MP J.Battulga, who owns the ‘Jenko’ company, also have shares in the bank. These are the largest three banks in Mongolia.

It is not only professionals working in the banking sector and journalists who try to find out who are the owners of these large banks and accuse them of being usurers. Many others in fact have the same opinion. Around the time when I was conducting field research in Dundgovi aimag, Batbayar, a young man who worked in Turkey, told me about Islamic Banks that allow loans with no interest. Batbayar, suggested that this is what Mongolia currently needs if the state is truly attempting to support housing and small- and middle-range enterprises, rather than allowing commercial banks to ‘spin money’.

As we can see mortgages are highly politicised and are not simply economic or social, especially at the moment when Mongolia is only a few months away from the next parliamentary elections in June. As Kh. Batsuuri states: ‘mortgage problem is becoming an advantage for rulers near the election’. Alongside amendments to the Mortgage Law, ruling Democratic Party leaders have decreased mortgage interest rates from 8 % to 5 %. Not long after, in the start of January 2016, this news received favourable comments from the public in the media. Some even openly declared that they would now vote for the Democratic Party, while others commented that this is rather a temporary ‘electioneering show’ (songuuliin show).

Absence of long-term policy making

On the 19th of January 2016, after about a month since the 8% mortgage loan was stopped, the Parliament of Mongolia approved an amendment to the Mortgage Law (Ul khodlokh ed khorongiin baritsaany tukhai khuuli). The amendment in article 27.1 now enables owners to have the right to issue permission to the mortgagee in cases when the mortgagees change ownership. This is not the only amendment. Interest rates have also decreased from 8 to 5 %, bringing possible future risk to the economy at large. As some economists, such as Kh. Batsuuri and J. Ganbaatar (PhD candidate at the American University)[2] explain, the mortgage loan should have financially supported itself without becoming a burden to the national economy if it had worked according to the original plan. Indeed, considering the current weak economic situation in Mongolia, Kh. Batsuuri questions whether the 3 % decrease in mortgage interest rates actually puts more pressure on Mongolia’s economy. According to his elaboration, the 8 % interest rate influenced the current economic crisis. For instance, the Mongolian government had to print more national currency in order to supply mortgage loans, which brought 13 % inflation, plus the price of flats dramatically increased.

The same critique has also been made by another economist, de Facto Jargalsaikhan. In his latest post he comments that ‘the technology to print more currency to develop the country is vigorously increasing in Mongolia’. Maybe there are many more economist who consider the 5 % interest mortgage a serious threat to the already weak national economy. It will possibly bring with it more currency printing, more inflation, more cheap mining deals, and more external debt, in addition to the existing more than 20 billion USD debt.

Speaker of Parliament Z. Enkhbold explains “why mortgage was stopped and what should be done”. Speaker of Parliament Z. Enkhbold explains “why mortgage was stopped and what should be done”. Source: http://economy.news.mn/content/232023.shtml

Speaker of Parliament Z. Enkhbold explains “why mortgage is crucial”. Source: http://sodon.mn/news/16035

According to the media, the decreasing interest rate of mortgages and their availability again, serves to satisfy those wanting to purchase an apartment, construction companies struggling to sell apartments, and commercial banks who make massive profits from mortgage interest rates. Passing this policy does not serve the potential damages that it might incur on the national economy. The only agent that consistently profits and is safely protected, by society, politics and the economy, are the commercial banks, owned by foreign investors and Mongolia’s oligarchs. They are indeed safely protected, firstly by the social demand for housing, and secondly by political decisions that meet public demands in order to receive more votes for the up-coming election, and thirdly the unstoppable financial system dominated and monopolized with loans.

The question that remains is; what was the politics behind changes to mortgages? Why were they stopped? Was it because of the constitutional court decision regarding the violation of basic human rights and monopolisation in the national economy? Or, was it actually the outcome of a genuine fight against the politically-empowered dominant business for the sake of fair competition? Or, further, was it in fact due to the political conflicts between large business owners and their political allies? Is the 5 % interest mortgage another short-term political play to gain support prior to elections? In this fractious political climate, who is actually taking care of the long-term interests of the national economy?

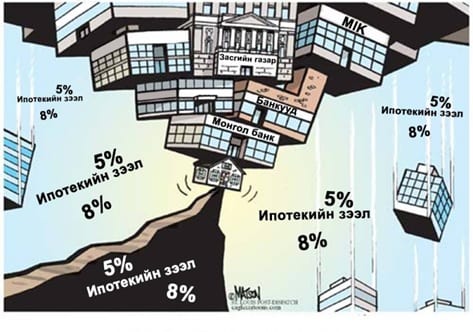

Mongolian banks teetering on the edge, with 5 and 8% mortgages crashing. Source: http://www.trends.mn/n/4709 (Original source: Modkraft)

[1] See also: https://www.facebook.com/ganbaatar.sainkhuu/videos/1089739141060523/?theater

https://www.facebook.com/ganbaatar.sainkhuu/videos/1089540537747050/?theater

For soyoljson lombard “culturalised pawn shops” also see http://www.fact.mn/204265.html

[2] Rebecca Empson and D. Bumochir’s skype interview with Ganbaatar Jambal, January 2016.

30 Responses to “The Politics of the Mortgage Market in Mongolia”

- 1

-

2

Marissa Smith wrote on 1 February 2016:

https://www.facebook.com/groups/240237646168997/ and https://www.facebook.com/groups/1418929108430191/

These are the ones I found Tuya, are there others?

-

3

Guest wrote on 22 February 2016:

This is why Mongolia needs an independently operating central bank that sets interest rate according to the market, free from political pressures.

-

4

Bumochir wrote on 22 February 2016:

I think you are right about the independent central bank. But it might be difficult to make completely independant in the current situation, with “unhealthy” politcal structure and governance and foreign development advocacy.

-

5

Internalizing External Debt | UCL Emerging Subjects Blog wrote on 24 February 2016:

[…] about how to pay a hefty monthly mortgage on an apartment he bought a couple years ago through the 8% mortgage scheme. Additionally, following the government’s adoption of a new tax law last August to get tax […]

-

6

Монгол дахь ипотекийн зээлийн бодлого | Шинжээч – Үндэстний Сэргэн Мандлын Сүлжээ wrote on 11 May 2016:

[…] болон АНУ-ын Их сургуулийн докторант Ж. Ганбаатар [2] зэрэг зарим эдийн засагчдын хувьд, хэрэв ипотекийн […]

- 7

-

8

Гадаад өрийг дотоодчлох нь | Шинжээч – Үндэстний Сэргэн Мандлын Сүлжээ wrote on 26 July 2016:

[…] зээл авч чадаагүй аж. Хоёр жилийн өмнө ипотекийн 8%-ийн хүүтэй зээлд хамрагдан худалдаж авсан орон сууцныхаа зээлийн […]

-

9

Ideologies of mortgage financing in Mongolia | UCL Emerging Subjects Blog wrote on 16 March 2018:

[…] the issuance of the 8% ipotek loan from the central system has been varying, including it being paused at the end of 2015, and resumed in varying ways at different points […]

-

10

Bigo88 wrote on 25 February 2023:

Slot online Gaming is one of the many online slot game provider sites with bets applying authentic Indonesian money. On this page you will not only be able to enjoy slot games online.

-

11

madu88 wrote on 25 February 2023:

The most famous Game slot online which can be the main choice for you is the Joker123 game which has been present in Indonesia for a long time around 2000 and has lasted forever.This game is famous for its very striking yellow logo.

-

12

Dewataspin wrote on 25 February 2023:

Dewataspin is a slot game that is always an option in slot games Rtp Slot Gacor Online is widely used by bettors as a place to bet.

-

13

Gaspoll88 wrote on 25 February 2023:

Gaspoll88 is game slot gacor the best undeductible credit deposit that provides trusted online slot games with the highest RTP in Indonesia.

-

14

Gigaspin88 wrote on 25 February 2023:

Gigaspin88 the first agent for Situs Judi Slot Online in Indonesia, to make it easier for members to make transactions now.

-

15

Jayaspin wrote on 25 February 2023:

Pragmatic play is one of the most well-known slot online indonesia and is the best slot game both in Indonesia and internationally.Pragmatic Play is the best recommendation for you and won the most complete best of online slots award of all time.

-

16

Kudabet wrote on 25 February 2023:

Kudabet is The Most Trusted Agen Bola Piala Dunia Terpercaya which is a type of provider that is easy to play.

-

17

Jazmin wrote on 16 March 2023:

Discover the latest new dress design by Jazmin Clothing. This stunning new collection features unique patterns and beautiful fabrics that are perfect for any occasion. Shop now and elevate your wardrobe with the newest and most stylish dresses of the season.

-

18

casinosite wrote on 21 March 2023:

I’ve been troubled for several days with this topic. casinosite, But by chance looking at your post solved my problem! I will leave my blog, so when would you like to visit it?

-

19

Honey wrote on 22 March 2023:

Thank you for sharing, Such a nice blog you have. Come visit my amazing fun online game website : https://www.sasthoidami.com/2023/03/honey.html

-

20

metroshoes wrote on 3 April 2023:

Get ready to step out in style with our stylish and comfortable men shoes! Our shoes are crafted from the finest material and seamlessly combine fashion with comfort. Our signature collection is tailored to perfection and will make you stand out in any crowd. With a wide variety of colors and sizes, you’ll find the perfect shoes for any occasion and be sure to turn heads everywhere you go.

-

21

chinyere wrote on 3 April 2023:

A simple dress design can make a big impact. Chinyere is one of the top clothing brands in Pakistan for its unique and simple dress designs. Whether you’re looking for a casual dress to wear during the day or a more formal dress for an evening out, Chinyere has something to suit your needs.

-

22

Belivepk wrote on 3 April 2023:

Belive Girls Tops and Tees. Belive is a brand of great long shirts for girls. Each and every long shirt has your back, made by the best designers and innovation in mind.

-

23

Sasthoidami.com wrote on 11 April 2023:

Your articles are informative and I like the way you are writing…

Strawberry Benefits for Health – স্ট্রবেরি খাওয়ার উপকারিতা ও অপকারিতা -

24

Mushtaq wrote on 23 April 2023:

Check out the latest Jazmin collection in Pakistan online at Mushtaq. Explore the wide range of branded dresses online at Mushtaq clothing. Get your favorite dresses online in all over Pakistan at low prices.

-

25

Ammara khan wrote on 27 April 2023:

Discover the latest kurti designs for girls online at Ammara khan. We offer the best kurti for girls online all over Pakistan. So, order your favorite designs online at reasonable prices today.

- 26

-

27

manojey wrote on 14 May 2023:

Get the latest link to download cracked pc software winrar 64 bit full crack v6.10 software for PC Windows. Winrar free download full version is available in this article!

-

28

Tere Ishq Mein Ghayal wrote on 23 June 2023:

Watch Online Tere Ishq Mein Ghayal latest Desi Serial Drama Today Full Episode at Colors Tv Online, Voot,Tere Ishq Mein Ghayal Full Episode dailymotion video download.

Tere Ishq Mein Ghayal -

29

Tere Ishq Mein Ghayal wrote on 23 June 2023:

Watch Online Video Episode Tere Ishq Mein Ghayal , Colors Tv New Drama Serial Tere Ishq Mein Ghayal Latest All Episodes Online , Tere Ishq Mein Ghayal Full Episode Online, Watch Tere Ishq Mein Ghayal online today episode.

Tere Ishq Mein Ghayal -

30

gojek game slot wrote on 11 July 2023:

Situs gacor Gojek Game slot Agen Resmi dan terpercaya yang sangat sering memberikan kemenangan jackpot maxwin yang gampang sekali untuk para pemain menangkan. Julukan Gacor pun merupakan gabungan kata dari Gampang dan Bocor yang melambangkan suatu permainan slot itu gampang menang.

Close

Close

This is an interesting research into the housing project in UB. While there are those who argue that banks are cashing on the housing market there are also those who argue that the “8 percent mortgage program” acts almost like a gift from the state if you use it wisely. I came upon this group on facebook called “8 huviin zeel” where members share their experiences on how to counter balance the debt against their savings.