“Shakhaanii Business”: Shared Debt, Privatization of Profit, and (Re-)Emergent Corruption Discourses in Mongolia

By uczipm0, on 2 March 2017

By Marissa J. Smith

Marissa J. Smith obtained her PhD from Princeton University’s department of anthropology in 2015, after defending a dissertation about Erdenet and its position in local, national, regional, and international contexts. She currently teaches at De Anza College in Cupertino, California.

With presidential elections on the horizon, as the Parliament called its fall session into recess and Mongolians began preparations for the Lunar New Year, Tsagaan Sar, major developments materialized regarding two particular issues that since the June 2016 parliamentary elections have become foci of interrelated concerns, controversies, and conspiracy formation about national debt, national development, and international mining projects, long noted and discussed on this blog.

The two issues are: 1.) the Parliament’s vote on February 10 that the state take (törönd avakh) the forty-nine percent share of the Erdenet Mining Corporation, deeming illegal the controversial sale of the shares on the and 2.) the announcement on February 19 of a “staff-level” agreement worked out with the IMF, $440 million dollars through a three-year “Extended Fund Facility” program. This announcement included that around five and a half billion dollars of “support” from China, Japan, South Korea, the Asian Development Bank, and the World Bank were also expected. China confirmed the extension of an over two billion dollar currency swap on February 21 during the diplomatic visit of Foreign Minister Ts. Munkh-Orgil, while Erdenet was not officially addressed during Munkh-Orgil’s visit to Russia on February 13-14.

As noted and discussed on this blog, the senses prior to and just after the summer elections were of slow-down, “stalling,” “resisting closure;” the feeling may now be characterized as of urgency, sped up, as the first of a billion dollars’ worth of loan payments come due this year and presidential elections approach. With $580 million due for maturing bonds in March, the announcement of the IMF decision has been met with some relief. However, this relief has also been mixed with suspicions and speculations like those around the highly controversial “matter of the Erdenet 49%.” Some have also tied the two together:

“The $550 [sic] million of the IMF matches the amount of money that the 49% of the Erdenet enterprise was purchased for. It seems that the Mongolian People’s Party (MAN) is “settling accounts” of/with the people.”

Both of these events are easily placed in narratives noted and discussed in this blog. With the IMF package, there are ever more loans than can be paid off, as more loans are taken to pay for loans. While much more on the IMF package and associated “projects” from the ADB, World Bank, Japan, and South Korea can be expected after Tsagaan Sar, for now the announcement of stagnant salaries and increased taxes associated with the IMF’s conditions for the loans has been at the center of concern. The major worry with the Erdenet 49% is that shares (khuv) have been, and will continue to be, wrongly distributed. As I have written about elsewhere, while international headlines described the action as “nationalization,” what is expected is a re-privatization, one that will favor a small group of politicians, working together across party lines (see Bumochir Dulam’s post on Mongolia’s deficit of institutionalized and regulated opposition politics) and foreigners (with some of the major politicians accused hailing from minority ethnicities subject to being questioned as to their degree of “Mongolness,” like many of the residents and employees of Erdenet itself).

“The country has no money, has taken loans from the IMF and China, there will be taxes and fees on the citizens, salaries will not increase, they say. The Ulaanbaatar City Council head SANDUI LIVES IN LUXURY on budget money!!”

Members of MANAN milking Erdenet, the “exhausted cow.”

How are these two issues connected? The IMF cites predictions of a return to eight percent growth in the national economy by 2019, but why is the premise that privatization will generate excess wealth to pay off loans unbelievable and genuinely questionable, from the perspective of Mongolian citizens as well as an anthropological perspective?

Who Owns the Shares?

Beginning a period of field research this past summer, I arrived in Mongolia just one day before the Parliamentary elections. After settling in my hostel, I glanced at twitter and saw something about Erdenet trending (before now, highly unusual), but with arrival errands I was unable to look into the matter beyond noting a connection with the discourses about “offshore” assets that had broken into Mongolian political commentary in spring 2016 with the release of the “Panama papers.” The night of elections, I attended a party with other foreign researchers and journalists, where I was told that Prime Minister Ch. Saikhanbileg had made his announcement that Erdenet was now “100% Mongolian.”

Returning to twitter to take a closer look, I found that this very notion of Erdenet having become “100% Mongolian” was a major point being refuted in the tweets I had been seeing. In conversations considering the election results, consensus quickly emerged that the timing and grandiosity of the announcement had been a key element in the Mongolian People’s Party’s taking eighty-five percent of the Parliament, the announcement backfiring badly for Saikhanbileg and his Democratic Party. As I spoke with Mongolian friends with varying degrees of relation to Erdenet and the Erdenet Mining Enterprise, the theme of “who has taken the 49%?” continued to dominate conversations. Everyone, not only Erdenetchuud, the people of Erdenet, felt dispossessed. The matter did also come into my arrival errands, as while I waited to have a notarized copy of my passport made near the Government Building the morning after the election, the notary held court with clients on the issue of who had the 49%.

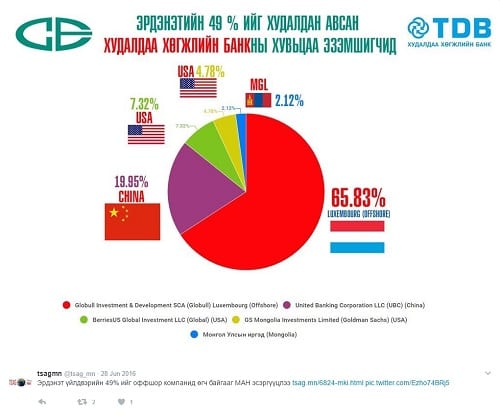

Answers to this question ranged widely: an eye-catching tweet showed a pie chart with the percentages of the Trade and Development Bank owned by shareholders in China, Luxembourg, United States, and Mongolia (just over two percent); those in and close to Erdenet tended to allege that the 49% had gone or would go into Chinese hands; others focused on individual politicians, doing politics in the way noted by Rebecca Empson: “speculation and circulation of rumours, of factions, motivations, alliances and actions of individuals dominates political talk.” A friend who had worked at Erdenet while I conducted dissertation research there and was now living in Ulaanbaatar also framed things in this way a few days after the election, listing everything that had gone downhill since changes in political appointments following the 2012 elections. Her relatives had been compelled to retire, access to the sport center had been restricted with entrance fees, and there was speculation a national-level politician would take the vacation resort. She also told me how she was one of the few regular salary-earners in her extended family and was helping to pay off the mortgage on an apartment in the name of a family member while living in another apartment owned by still another family member, caught in an arrangement that reminded me of the story in the post by Bumochir Dulam.

The shared nature of debt makes privatization excessively threatening, go beyond expropriation, in ways that make scalar and even erase distinctions between consumer, corporate, and national debts. If wealth, and the relations generating wealth, are distributed into closed groups or exit from the national community, the burden of debt (made heavier with increased taxes and stagnant and evaporating wages) remains widely shared with less possibility of being alleviated. A pattern has even emerged in which it at least appears that more and more debt is taken on as shared, while ownership and possession of capital and profits is made increasingly exclusive. If the knowledge of where this ownership and possession lies and moves is unavailable, its realm of exchange cannot be entered, and thus “transparency” (shilen dans) has become a cornerstone of President Elbegdorj’s policy without stemming the flow of suspicion and speculation over conspiracies involving members of the government and business elite.

As posts on this blog from over the past year articulate, the mirroring of debt in personal life and one’s own business and household on the one hand and at the level of the national economy and international relations on the other are not merely apparent. As Lauren Bonilla put it last February, the “external debt” is also “internal debt” – for individual Mongolian citizens this debt is their own, and also for members of government who have calculated the share of the debt as held by every citizen (including pensioners and children). Most lately, at the end of January, as Mongolians were awaiting news on the IMF agreement and the Erdenet matter was being investigated in Parliament, major English news outlets reported that, “oddly enough,” Mongolian citizens were offering their own cash, jewelry, and livestock towards paying off the national debt. (This phenomenon and associated negative international attention were also mentioned by President Ts. Elbegdorj in his address to the Parliament before the vote on taking the 49%, which I assume is connected with the apparent encouragement of the practice by Prime Minister J. Erdenebat, though it has been stated that the donations, khandiv, will go into a separate fund and not be put towards debt payments. Both moves seem to demonstrate that the government members seek to take responsibility and authority for paying the debt onto themselves.) Bumochir Dulam also shows how the “8%” mortgage program tied not just individuals to the state bank, but also groups of friends and family, being at least informed by employees of commercial and state banks. The concerns of the Mongolian economists he cites as to who actually benefitted from the program and attendant negative effects on the economy broadly are apparently also borne by the IMF, who support legal reforms of the mortgage program and regulation of the state bank, passed at the end of the fall session of Parliament.

What is “shakhaanii biznes”?

On being told of the sale of the 49% on the election night in June, my reaction was of disbelief; having studied Erdenet for almost a decade I thought of the central roles I have seen the enterprise and city hold in relations not only between Russians and Mongolians (let alone other international relationships), but also among Mongolians; the great stresses that would be required to break these relations, the force with which these stresses would be resisted, and the massive scale of the potential fallout for the national economy and international relations, in which were also implicated the jobs and workplace communities of many of my friends, the infrastructure of the city of Erdenet, and the many Mongolians who accessed trade, schooling, healthcare, and employment more indirectly through association with the enterprise and its associated institutions throughout the city.

In the last two months, as I have followed news, opinion writing, and social media during the course of investigations by the Standing Committee on Law of the Ikh Khural, I have noticed a category for a particular kind of corruption that I had not picked up on before. The term shakhaanii biznes, or simply shakhaa, appeared particularly in connection with discussions of apparent conflicts of interest involving politicians most centrally involved with the movement to take the 49%. The term struck me not only as a category of corruption accusation I had been unfamiliar with, but also due to the force of its possible valences; a possible translation is “pressured” or “forced business,” but a related or homonymic verb with the meaning “to shoot” is commonly used in Mongolian as a strong swear word, analogous to English’s “f-word.”

While this concept and its contexts bear more investigation, the situation being described here is apparently that of trade being kept within a closed circle of participants to the detriment of those outside – as well as inside? The term might also refer to the “pressure” upon those inside to participate in the activity. In December and January the Buryatia, Kalmykia, and Mongolia-focused Russian-language news outlet asiarussia.ru ran two pieces (here and here) related to the issue of Erdenet’s 49% with shakaanii biznes in the headlines and with suggested translations, including tenevoi biznes (“business in the shadows”). Sociologist Alena V. Ledeneva, a major contributor to academic discussions about “barter economies” and “corruption” in postsocialist economies, devotes a chapter of her How Russia Really Works to tenevoi biznes, describing the way that networks of barter, in which the many participants she interviewed expressed being compelled to participate, kept the Russian economy itself, as well as individual Soviet enterprises (similar to Erdenet) going through the 1990s and beyond.

As I re-read Rebecca Empson and Lars Højer’s separate work about Mongolian pawnshops (lombard), it strikes me how it is not sharing or transferring property or personal substance itself that is objectionable, but being compelled to do so in conditions of anonymity or uncertainty, as the effects of these movements are so wide-ranging, potentially infinitely so. Such transactions involve and constitute ongoing relations, in which consequences and risk, as well as benefits and potential benefits, are shared. As Rebecca Empson shows, these “chains of debt” extend well beyond the lombard and the person handing over property in exchange for a loan, as she observed, remarkably, that a debtor had to also provide a list of telephone numbers belonging to other people also “accountable for payment.” The lombards themselves, Empson notes, are also “just ticking over;” rather than being profit-making ventures as her interlocutors alleged, they were as bound in chains of debt as their “clients.” Debt relations are not between a debtor and a creditor, but form “networks” and “webs” in which these distinctions become perspectival.

It seems that large enterprises and national economies and their politics are not so different, and thus are really involved and implicated in much more small-scale seeming interactions after all. To analyze Mongolian economy and politics, we must not lose sight of these points as we encounter one particular corruption accusation or conspiracy theory after another.

79 Responses to ““Shakhaanii Business”: Shared Debt, Privatization of Profit, and (Re-)Emergent Corruption Discourses in Mongolia”

- 1

-

2

Marissa J. Smith wrote on 2 March 2017:

Hi Dan,

I would say no, because extortion implies something that is overwhelmingly beneficial for only one side and in the context of an extreme power differential. The kinds of exchanges being referred to here would appear more like/likely be labeled, in an American context, “conflicts of interest.” (For instance, one of these stories in asiarussia.ru covers consulting contracts between the son of one of the members of Parliament investigating the sale of the 49% and Erdenet GOK.) But, there is something more of an extortion-like dynamic (on both sides) than how “conflicts of interest” generally are assumed to be.

Thanks for the comment! Like I said in the post, this is something I am still looking into.

-

3

Daniel Murphy wrote on 2 March 2017:

Yeah, the concept is an interesting ‘racket’ sauce – some elements of embezzlement, a little like extortion, a general sense of good ol’ conflicts of interest – I look forward to reading more.

-

4

Marissa J. Smith wrote on 4 March 2017:

Suggested translation for “Shakhaa business” from a twitter correspondent, @altanalim. “Crammed business.” Very interesting!

-

5

Rebecca Empson wrote on 2 March 2017:

Thank you so much for this post and the fantastic linkages! I particularly enjoyed the way you show how webs of obligation and debt scale from small businesses to large enterprises and national economies. During our ‘Mongolian-made capitalism conference’ (Ulaanbaatar, November 2016) I presented a paper that I am writing-up on the prevalence of business ‘groups’ among small to medium businesses. These ‘groups’ allow small businesses to ride-out the economic downturn as they share collateral, apply for tenders, and buttress each other when one business goes ‘bankrupt’ for a while. They allow them to pool their finances for loan applications and auditing reports, and share forms of property and the profit from their sales, and they are based on personal networks of debt and patronage. Not so much the ‘Economy of Favours’, then, but an Economy of Survival in today’s volatile web of debt that erases distinctions between individual businesses and individuals themselves. My question is how this shared or anonymised debt is carried when being associated or pressured into association with a failing business (group) is a way holding in place hierarchies? As you say, ‘shakhaanii biznez might also refer to the “pressure” upon those inside to participate in the activity’.

-

6

Marissa J. Smith wrote on 2 March 2017:

Hi Rebecca,

So glad that the issues of “scale” are resonant. It’s something I found people resistant to in other forums! I am very interested in these small business networks, and am going to go through the results of the Capitalism workshop reported on the blog here now. (And thank you again to you and the group for producing so much interesting material to engage with, and hosting my post and the discussion here.)

I wonder if these networks have longer pasts, and what those look like? I am reminded of “young professionals” networks I have come across, including chapters of international organizations like Rotary, as they have played out in Mongolia (within Erdenet, but groups based in UB and expats/students in the US as well… it would be good to bring this up with Chima Anyadike-Danes). I will have to look at my notes. I heard accounts of these falling apart when it came to other kinds of relationships coming into play — people trading with one another, hiring one another. I haven’t heard so much of sharing debt and its liabilities with one another — but certainly would not surprise me. People’s complaint narratives on this I am speaking of are rarely so explicit since they were in the context of long term participant observation and and I have developed ongoing relationships with people involved, of course… this kind of thing gets into the territory of kharuul/khel am very fast. (And on the students abroad groups, there are relevant things going on with how people are challenged with exchanging currency to pay tuition, etc., which I also discussed with Chima recently.)

Your point about pressure to stay in “failing” networks is really interesting and related. The sense of the “pressure to participate” I was talking about was more of a “there isn’t anything else to participate in,” the risks outweigh the rewards, etc. — I think this is also what the participation in and disappointment with the “young professionals” networks, Rotary, etc. are grounded in. Obviously (as with the not making explicit accusations about the “young professionals” networks falling apart) there would be other (in other ways at least potentially sustaining, or for “surviving,” as you nicely put it) relationships involved in “business” networks of these kinds that would hold them together, even if the “business” were failing.

(I would also say that assertions that Erdenet, and associated businesses, are “failing” have definitely been exaggerated in the English language press at least, and also in at least some Mongolian contexts I know of. This is complicated though — statements on what constitutes “failing” economically are highly political, of course — and this is part of a longer piece I am working on about historical narratives about Erdenet that have come into UB-based popular discourses again in the last six months or so, that are very different from historical narratives that circulate in Erdenet.)

-

7

Bill Bikales wrote on 5 March 2017:

Marissa, thanks so much for another fascinating commentary.

One quick comment. Regarding the IMF program, you pose the question “why is the premise that privatization will generate excess wealth to pay off loans unbelievable and genuinely questionable, from the perspective of Mongolian citizens as well as an anthropological perspective?” Your premise that the growth projection of 8.1% in 2019 is linked to Erdenet or to any other privatization is incorrect, from all I have seen of the IMF program. The IMF growth projection, accurate or not, is in no way linked to Erdenet; it is based on Oyu Tolgoi phase 2 moving ahead, Tavan Tolgoi moving ahead soon and larger exports starting in 2019, and other large projects. Nor is it linked to any other privatization; even budget projections do not assume much revenue at all from previously announced government privatization plans (State Bank, MSE, etc).

It is still way too early to know what is going to happen with Erdenet 49%. It’s fascinating to see people’s speculation, but we’ll have to wait and see.

Re TDB ownership, the 2% Mongolian ownership that the pie chart shows is the shares owned by employees. The Luxembourg ownership stake is a corporation set up in 2012 by the Mongolian owners of the bank. There could be others, and it is certainly a bit murky.

thanks again

-

8

Marissa J. Smith wrote on 6 March 2017:

Hello Bill,

Thanks for comments on the TDB pie chart graph. Do you have any thoughts as to where they may have sourced that from?

I was not suggesting that the IMF growth project is linked to any single mining project or single privatization. However, while I agree that the IMF is likely not including Erdenet in its “key mining projects,” many Mongolians are. There is evidence that this includes key political actors as well. I will not comment further here on the reasons beyond the ones focused on in this post as to why OT Stage Two by 2019 is extremely unlikely. TT would also be well explored through the lenses I apply here, and similar work has been done on the blog here by the UCL team.

What is foundational to my analysis here (and generally), and those of many others which I describe in this post, is that the likelihood of any of the “key mining projects coming online” mentioned in the IMF statement I cited will include these issues of ownership and possession that are always far too complicated to be encapsulated by terms like “privatization” and “nationalization.” (It seems that the authors of the IMF statement agree and consciously avoids these terms as well.) These issues are also obviously entangled with the other specifically-noted reforms that the IMF has supported and is supporting and what their effects have been and will be. Some specific examples were noted in the discussion of my post on Mongolia Focus.

-

9

Bill Bikales wrote on 6 March 2017:

Thanks, Marissa. The pie chart is based directly on information from TDB’s own website and so is, presumably accurate. TDB was originally privatized in 2006 to an international consortium, but those owners sold it in 2007 to a group of Mongolian companies, led by Ulaanbaatar City Bank’s D. Erdenebileg. It is all somewhat opaque, but that ownership structure has remained largely the same since then. Not sure about the roughly 20% Chinese stake that is reported on the pie chart; it could be correct, I just don’t know and I haven’t heard that before. On the bank’s website it mentions “United Banking Corporation” as the owner of that stake.

Regarding the 2019 growth rate, I understand your point. Mine is simply that a big increase in growth has to come from some big change in production somewhere. Erdenet’s ownership has changed, but there is no reason to expect that by 2019 its output will increase massively. The main increase is expected to come from TT, where the government expects to move ahead with a deal with foreign investors in the near future. TT output cannot increase by very much without a rail link to the Chinese border, so that will have to be the first step and it will have to be operational by 2019 for these projections to make sense. Presumably the IMF think that is likely. OT perhaps as well. And some other large projects to a lesser extent.

We talk past each other a little, I know, coming from different professions and perspectives. But I hope this is useful. 🙂

-

10

Marissa J. Smith wrote on 7 March 2017:

Yes, the dialogue is very helpful, and thank you again. It isn’t easy!

I would need to do more research and thinking to comment more on the IMF’s logic on all this, but would be good to get your thoughts and perspective. Are they, essentially, very neatly separating the issues of revenue generation (what I take you to mean by production? FDI primarily in the form of international mining projects) from the management of these revenues (the change in the Development Bank of Mongolia laws, the mortgage program, etc.)?

My general starting assumption with privatization efforts is that they are assumed to have particular *systemic* effects resulting in economic growth. Of course this becomes more complicated in really significant ways when looking at different institutions, packages, etc., however, and I would have to do that before saying too much more on this I think. (Again, I am working on an account of different systemic effects that Mongolian proponents of “privatizating” Erdenet, over the past thirty or so years, have argued would/should happen — this should also reveal diverse meanings of “privatization” itself. I’m also particularly interested in seeing what the ADB package is going to look like…)

I also find the TT “reinternationalization” and RR coming by 2019 as part of increases in production unlikely, but anyways!

And thanks for the info on the TDB chart. I will let you know if I come up with anything that further enlightens where the “allegations” of 20% ownership are coming from…

-

11

Bill Bikales wrote on 7 March 2017:

Thanks, Marissa. ‘Revenue’ refers to cash inflows, usually government ‘revenues’ as in tax and other collections. GDP growth measures changes in total value added produced in the economy. So the IMF project that in 2019 there will be a large increase in production of, for example, coal, and/or copper, electricity, railway services, cashmere, etc. compared to 2018. Your use of the term ‘privatization’ is a bit confusing, because it means a change in ownership from state to private, and there is not much of that going on in Mongolia right now. Thanks again.

-

12

Marissa J. Smith wrote on 8 March 2017:

Yes, in this piece I certainly meant “privatization” in an expanded sense — as also indicated by the subtitle.

Relatedly, just saw this article from Reuters, looking for more now. More on how the ways to increase to production are currently staying out of the realm of “privatization” (of enterprises, parts of enterprises, at least)! http://www.reuters.com/article/mongolia-riotinto-idUSL5N1GL5KY

-

13

Two Recent Blog Posts on Erdenet 49%, IMF Package Controversies – Marissa J. Smith, PhD wrote on 7 March 2017:

[…] “Shakhaanii Business”: Shared Debt, Privatization of Profit, and (Re-)Emergent Corruption Disco… […]

- 14

-

15

Revisiting History: Debt and Protest during the Manchu Period | UCL Emerging Subjects Blog wrote on 15 May 2017:

[…] “Shakhaanii Business”: Shared Debt, Privatization of Profit, and (Re-)Emergent Corruptio… […]

-

16

Revisiting History: Debt and Protest during the Manchu Period | Шинжээч сүлжээ- Үндэстний хөгжлийн төлөө wrote on 5 June 2017:

[…] (ergo politicians’) debt by sharing and distributing it amongst themselves (see also Marissa Smith and Lauren Bonilla’s blog posts), as their politicians accrue more debt through the misuse of […]

-

17

Á Đông wrote on 24 February 2023:

Công ty TNHH xây dựng và thương mại quốc tế Á Đông xin được gửi đến Quý khách hàng lời chúc sức khỏe, lời chào trân trọng và hợp tác.

-

18

Andree Junior wrote on 2 March 2023:

Definitely imagine that that you stated. Your favorite justification appeared to be at the net the easiest factor to bear in mind of. I say to you, I certainly get irked whilst other folks think about issues that they just don’t understand about. You controlled to hit the nail upon the top and also defined out the entire thing without having side effect , other people can take a signal

Pindahan Rumah. Will probably be back to get more. Thank you

-

19

puja sarkar wrote on 11 March 2023:

Flower Delivery has become easy and affordable with our website. Order fresh flowers in India with us.

-

20

Balloon decoration wrote on 11 March 2023:

order Balloon Decoration for Birthday, anniversary and other special occasion of yours.

-

21

puja sarkar wrote on 11 March 2023:

Best Balloon Decoration available in India from professional decorators at an affordable rate. Book Today.

- 22

-

23

Printer wrote on 18 March 2023:

FREE printer driver for Windows, Mac OS and Linux, visit: http://www.my-hpdrivers.com

thanks alots and have nice day

-

24

slotsite wrote on 1 April 2023:

As I am looking at your writing, slotsite I regret being unable to do outdoor activities due to Corona 19, and I miss my old daily life. If you also miss the daily life of those days, would you please visit my site once? My site is a site where I post about photos and daily life when I was free.

-

25

dolphy wrote on 11 April 2023:

Thanks for sharing the article. I deal in bulk digital weight machine online, please visit us.

- 26

-

27

The Richero wrote on 14 April 2023:

Really informative article. Thanks for sharing this information with us. We deal with Lining shirt for men, get in touch with us for more details.

-

28

Carcosmic wrote on 17 April 2023:

What a blog. Really loved it. Visit ceramic coating at us.

Thanks for sharing -

29

casinsaa wrote on 18 April 2023:

Hello. Thank you Bye. See you again Hello. Thank you See you again. When the morning sun rises, when the morning sun rises, you start another tomorrow with the same people every day. Thank youhttps://casinsaa.com/

-

30

safetoto wrote on 19 April 2023:

I have been looking for articles on these topics for a long time. safetoto I don’t know how grateful you are for posting on this topic. Thank you for the numerous articles on this site, I will subscribe to those links in my bookmarks and visit them often. Have a nice day

-

31

jon wrote on 20 April 2023:

Real estate markets are cyclical: Real estate markets can experience booms and busts, and market conditions can vary widely depending on many factors, such as supply and demand, economic conditions, interest rates, and government policies. Belize Real Estate

-

32

Mushtaq wrote on 23 April 2023:

Experience the best of Pakistani fashion with the latest collection of Ramsha Clothing in Pakistan, available exclusively at Mushtaq. Discover premium quality, stylish designs, and unbeatable prices. Shop now and make a statement with the Ramsha brand.

-

33

Aarvee wrote on 24 April 2023:

We at Aarveecreation offer many different kinds of Wholesale Kurtis in surat which can be worn on any occasion with the right accessories. Kurtis comes in different fabrics and patterns and people prefer them according to their preferences.

-

34

binance wrote on 25 April 2023:

If you are interested in investing in virtual currency,

You may have heard of the ‘Binance’ exchange.

That’s because this exchange is currently the virtual currency exchange with the most users in the world.

Today, I would like to introduce a brief introduction of this exchange, the advantages you can feel, and even joining Binance.

바이낸스 할인 -

35

okbet wrote on 25 April 2023:

Highly recommended did this. Very interesting information. Thanks for sharing!

SDC Championship -

36

lion wrote on 3 May 2023:

In addition to the popular brands I mentioned earlier, there are many other local and international brands that offer a wide range of phone cases in Australia. Some of these brands include EFM, Case-Mate, Cygnett, and Bellroy. phone cases australia

-

37

John Wick wrote on 3 May 2023:

Handbags can be made from various materials such as leather, canvas, nylon, or even recycled materials, and they can be designed for different occasions and settings. For example, a clutch bag is typically used for formal events, while a tote bag is more suitable for daily use, and a backpack is perfect for outdoor activities or commuting. personalized tote bags

- 38

- 39

-

40

gloablebrands wrote on 5 May 2023:

Excellent blog post. Thanks for sharing

You can check out Dubai perfume brands blog at us. -

41

SMM Panel One wrote on 14 May 2023:

SMM Panel One offers the best SMM services that are simply accessible to everyone. Through our genuine SMM panel services, we have assisted many businesses in gaining greater insights. If you choose us for your business, then we can help you develop your online presence across multiple social media platforms such as Facebook, Instagram, LinkedIn, YouTube, etc. because we believe in 100% customer satisfaction.

-

42

manojey wrote on 14 May 2023:

WinRAR Crack is the zippy share.top most popular file compression software with a popular and exclusive compression format. Moreover, It offers exceptional

- 43

-

44

replitown4 wrote on 22 May 2023:

I saw your writing once, but I’m spending my day looking at your writing every day well. If I had known your writing before, I would have seen it sooner. Thank you. I’m looking at it well레플리카사이트

-

45

Alexis Love wrote on 22 May 2023:

Doing this is strongly recommended. Intriguing details, indeed. @free games

-

46

Abhishek wrote on 25 May 2023:

Our company CherishX https://cherishx.com will turn profitable and will help indian economy

-

47

replitown4 wrote on 27 May 2023:

I was so touched when I saw your writing. It’s a really good writing. I want to find your writing every day and see it. I hope you continue to send me good writing남자레플리카

-

48

villy wrote on 29 May 2023:

Online brokers often provide a wealth of educational resources to help investors make informed decisions. These resources can include articles, tutorials, webinars, and even virtual trading platforms to practice investing without risking real money. Such resources can be valuable for beginners or those looking to expand their knowledge. Brokers online

- 49

- 50

- 51

-

52

Prestige Park Grove wrote on 20 June 2023:

This post couldn’t have come at a better time. It’s just what I needed to hear today. Your wisdom and positivity are contagious. Thank you for spreading positivity!

Prestige Park Grove -

53

Prestige Lavender Fields wrote on 20 June 2023:

Prestige Lavender Fields

This post has truly resonated with me. Your ability to articulate complex ideas in a relatable way is commendable. Thank you for sharing your thoughts and inspiring others. -

54

Prestige Southern Star wrote on 20 June 2023:

Prestige Southern Star

I couldn’t agree more! This post really resonated with me and provided a fresh perspective on the topic. Thanks for sharing your thoughts. -

55

Godrej Splendour wrote on 20 June 2023:

Godrej Splendour

I really enjoyed this thought-provoking article. Your unique perspective challenged my preconceptions and encouraged me to expand my thinking. -

56

Provident Ecopolitan wrote on 20 June 2023:

I’ve been reading your site for a long, and I have to admit that you never let me down. Like the others, this post is exceptionally well-written and has expanded my thinking.

-

57

Prestige Serenity Shores wrote on 20 June 2023:

Thank you so much for your kind words! I’m thrilled to hear that the post resonated with you and that you found the ideas articulated in a relatable manner. It’s my aim to make complex concepts more accessible and relatable, so I’m delighted to know that it has had that effect. Inspiring others and sharing valuable thoughts and insights is a great joy for me, and I’m grateful for the opportunity to do so. If there’s anything else I can assist you with or if you have any further feedback, please feel free to let me know. Thank you for your support and encouragement!

If you want more help, let me inform at Prestige Serenity Shores -

58

Provident Deansgate wrote on 20 June 2023:

That which you have provided is exactly what I needed to know. All of my questions have been answered in detail in your blog post, and you’ve given me new information. Provident Deansgate

-

59

Online Dissertation Writing Help wrote on 21 June 2023:

Writing a dissertation can be a daunting task for any student. With the help of online dissertation writing services, students can get the assistance they need to write their dissertations with ease and accuracy. These services provide students with access to experienced writers who are familiar with the format and structure of dissertations. They also have access to an extensive library of research material and resources that can be used for their dissertations. With online dissertation writing help, students can save time and effort while ensuring that their dissertations are well-written and meet all academic requirements.

Close

Close

Would ‘extortion’ be a good translation of ‘shakhaanii biznes’, given its coercive dynamic?