Worksheet 1: User Input & Project Specifications

By zceie01, on 1 June 2014

User input provided in worksheet 1 is used to produce a project risk profile and estimates for the duration of subsequent development stages. In addition, user input provided in worksheet 1 forms the basis for the cash flow statement, and NPV calculations produced in worksheet 2, as well as the scenario analyses produced in worksheet 3.

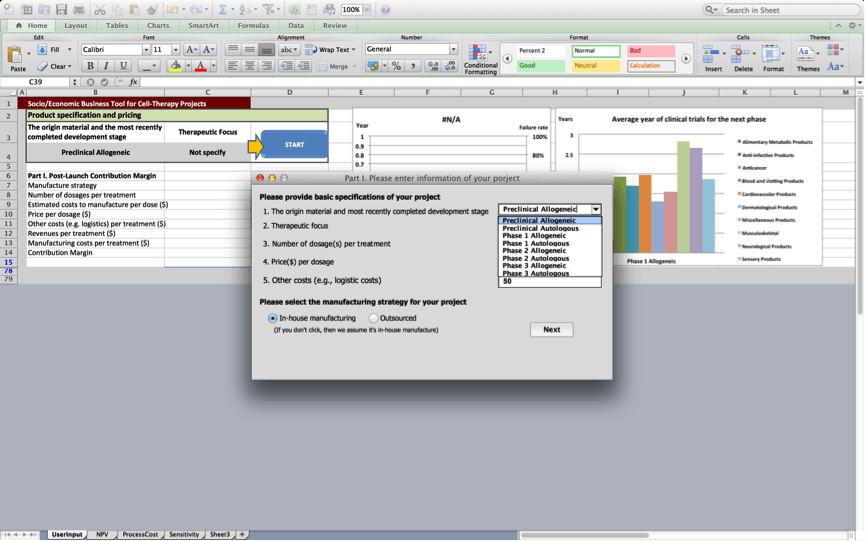

After the user presses the “start” button, users are asked to provide basic specifications of the product in box 1:

Box 1: Product specification and pricing

Box 1 prompts the user to provide a number of product specifications and information about the product’s pricing at launch.

1. Origin material and most recently completed development stage

The user specifies whether the cell therapy is an allogeneic or autologous cell therapy product. In addition, the user should specify the latest stage of the development process the product is (about to) complete. These specifications will be used to assess the development times and risks associated with the cell therapy product and will for example inform the duration of the different development stages and the discount rates that are applied to cash flows in the cash flow statement.

The earliest development stage that users can indicate for their product is the pre-clinical stage. Thus, the tool is especially useful for business planning and valuation exercises for products that are entering one of the formal clinical trials stages. We suggest that users who are conducting business planning and valuation exercises for projects that are not yet ready for clinical trials use the tool to illustrate the valuation and development path for projects once these enter clinical trials.

2. Therapeutic focus

The user should select the primary application area of the product. This information will be used to assess the development times and risks associated with the cell therapy product. If the user does not specify a specific therapeutic focus, the tool will use industry-level averages to assess the project’s risks and expected development times. Also, if the user specifies a specific therapeutic focus but the tool does not contain data on more than one project with a similar therapeutic focus (for example because the user is among the first to develop a cell therapy project in that area), cell therapy industry averages are used to calculate expected risk rates and development times associated with the project.

3. # dosage(s) per treatment

The user should select the average number of dosages that patients will be prescribed as part of their treatment. This information will be used as a part of revenue calculations.

4. Price($) per dosage

The user should specify the price the user will charge payers per dosage. This information will be used in the calculation of revenue streams associated with the project.

5. Manufacturing

The user is asked whether the manufacturing strategy entails in-house or outsourced manufacturing. If a user selects “outsourcing” as a manufacturing strategy, the total manufacturing costs will be 30% times higher than if the user selects “in-house manufacturing”. However, the user will not incur separate manufacturing set-up costs if the “outsourcing” option is selected.

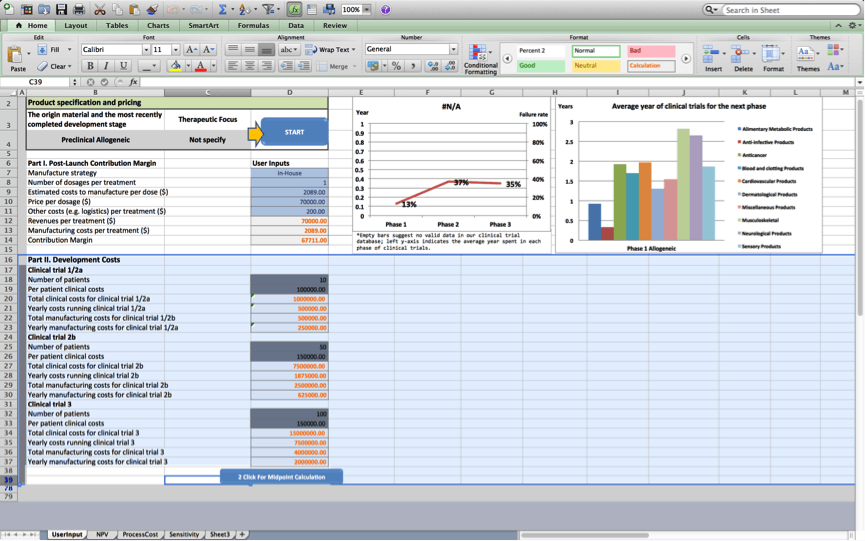

Once the user presses ‘next’, figures 1 and 2 are updated based on the project’s characteristics. The line in Figure 1 presents a customised risk profile for the user’s cell therapy project, that highlights expected chances the project will fail at subsequent development stages based on data the BRITS team collected on similar projects (i.e. projects that use the same origin material and have a similar therapeutic focus). The bars in figure 1 present a customised overview of the expected development times for the project during subsequent stages based on data, the BRITS team collected on similar projects. No bars are shown if we have fewer than 2 observations for projects that are similar in terms of the used origin material and the therapeutic focus. Figure 2 displays average durations of the clinical trials stage the project will progress to next. The figure displays historical averages for projects using the same origin material and breaks these down by therapeutic application.

Failure rates displayed in figure 2 will be used to discount cash flows in worksheets 2 and 3; Development times displayed in figure 2 will be used to determine the duration of the various stages of development in the cash flow statements of worksheets 2 and 3.

By clicking ‘next’, at the bottom of box 1, the user also prompts box 2 to appear.

Box 2: Post-approval manufacturing costs

In order to provide users with an estimate of manufacturing costs of the product once it is approved, the user is asked to provide the following information:

- The number of cells in a single dosage.

- The estimated number of dosages that users expect to manufacture per year after the product is approved.

- The estimated lot sizes used in the manufacturing process.

Based on the information provided by users, the tool calculates the expected manufacturing costs per dosage based on optimal manufacturing specifications. These expected manufacturing costs will be used to calculate post-launch manufacturing costs in the tool’s cash flow projections. If the user wishes to change the expected post-launch manufacturing costs, the user can override the manufacturing cost estimate and provide an alternative estimate at the bottom of box 2.

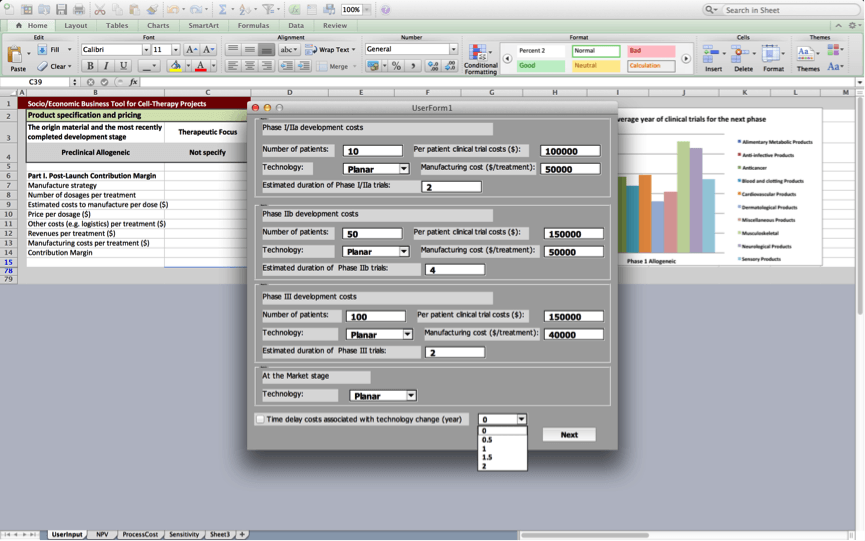

Box 3: Development costs

In order to calculate product development costs incurred for running clinical trials and for manufacturing the product used during trials, users are prompted to provide specifications for the clinical trials protocol, and manufacturing processes they plan to use. Estimates will be more precise if the user is able to provide more project-specific values in box 3. However, the BRITS team has collected data on ‘typical’ values for running clinical trails and manufacturing processes for allogeneic cell therapy projects. These values will be used as default values unless the user inserts project-specific ones.

Users are asked to provide information on the number of patients that will be enrolled during each of the subsequent clinical trials, per patient costs of running these trials, manufacturing costs for a single treatment used in clinical trials, and the manufacturing process being used (Planar, MC-SUB, or other).

The BRITS tool estimates the duration of the different clinical trials stages based on information about the origin material and therapeutic focus of the project, which the user provides in Box 1: Product specification and pricing. However, the user may override the durations for the different clinical trials stages that are based on average development times for similar projects that are provided by the tool by inserting alternative values here.

The user may click the box ‘Consider time delay costs if technology changes (mo)’, to account for time delays that are a result of changes to the manufacturing process.

Box 3.1: Manufacturing set-up costs

Manufacturing process costs constitute a substantial cost component of early-stage cell therapy projects. Box 3.1 helps users incorporate these costs in business planning and project valuation exercises. Estimates will be more precise if the user is able to provide more project-specific values. However, the BRITS team has collected data on ‘typical’ values for costs associated with (changes in) manufacturing processes for allogeneic cell therapy projects. These values can be found in Case Study 2, the Process Change Case. This case study provides ‘typical’ values for a range of manufacturing strategies that can be employed in the development of cell therapy projects.

Users can enter expected costs associated with the different clinical trial stages as well as the pre-market stage when firms set up manufacturing processes for the marketed product. Manufacturing process costs are divided up across the following categories:

- Process development costs

- Technology transfer & process characterisation costs

- PPQ batches costs

- Product stability costs

- Comparability & bioequivalence costs

- Clinical trial bridging study costs

Users are recommended to include clinical trial bridging study costs if they decide to change manufacturing technology from one clinical trials stage to the next. These costs are often estimated by multiplying the clinical costs for one patient enrolled in clinical trials during the preceding stage by fifteen.

Finally, by checking the box ‘time delay associated with technology change (years)’, the tool will incorporate this delay and add the time required to change the manufacturing technology. Delays will be reflected in longer development times in the cash flow statements of worksheets 2 and 3.

Once the user presses ‘next’, the tool consolidates the information provided into two categories, namely Part I. Post-Launch Product Contribution Margin , and Part II. Development Costs.

- Part I provides an overview of the components that make up the contribution margin associated with the cell therapy product once the product is marketed.

- Part II provides an overview of the components of the project’s development costs.

Box 4: Market penetration, staff costs, and other, fixed costs

Box 4 prompts the user to provide information about the expected market penetration at launch, the annual growth rate of the product’s market, staff costs, and other fixed costs associated with the project.

Market penetration

The user should provide estimates of the potential market size for various applications of the product (i.e. as a frontline treatment, as a second line treatment, or other). In addition, by clicking on the drop-down box the user can provide an estimate of the market penetration, measured as a proportion of the target market that is reached during the first year the cell therapy is on the market. The tool assumes that during each of the subsequent year this level of market penetration doubles until, 100% of the target market has been reached. Information on market penetration and growth is used to calculate the revenues generated by the commercialisation of the cell therapy that are displayed in worksheets 2 and 3.

Staff costs

The user should provide estimates of numbers of employees that will be employed across different staff roles along the project’s development trajectory. Default values for salary levels associated with these roles have been obtained from a recent study on staff compensation levels at biotechnology firms published in Nature Biotechnology. The user can change these salary levels according to the specific circumstances of the project. Information on staffing will be used to calculate staff costs in worksheets 2 and 3.

Other, fixed costs – A third part of box 4 allows the user to insert information on other, fixed costs that are expected to be incurred along the various commercialisation stages of the cell therapy project. These costs will be incorporated into the project costs displayed in worksheets 2 and 3.

Once the user clicks on the ‘next’ button, the information provided in box 4 is automatically consolidated in a number of figures that break down various cost items.

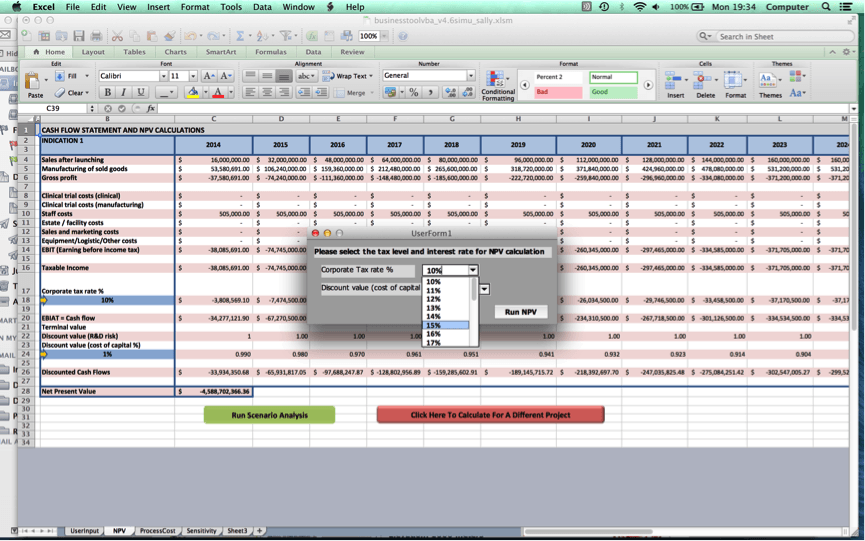

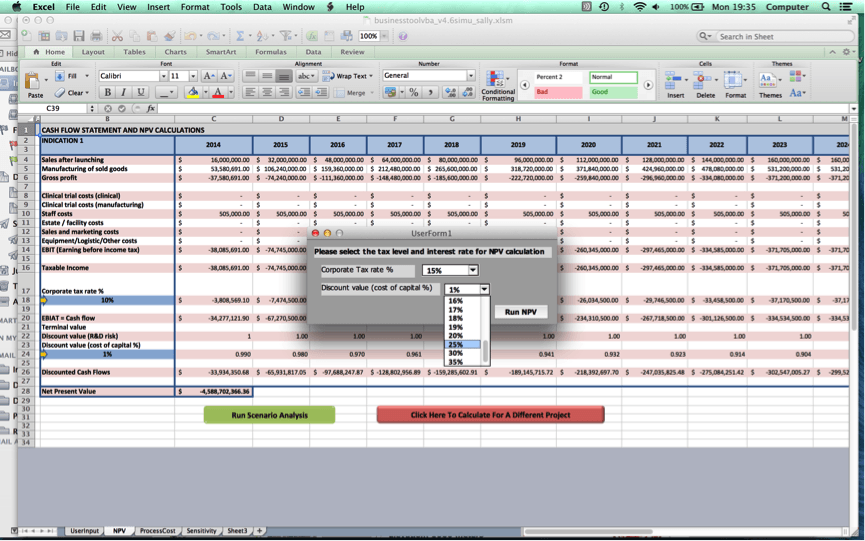

Once the user clicks on ‘Go to NPV analysis’, the user is ushered to Worksheet 2 where a cash flow statement for the user’s cell therapy project and NPV value will be produced.

Close

Close