Case study 2: Dividing up equity

By zceie01, on 1 June 2014

Assessing funding needs and the value of equity in entrepreneurial cell therapy projects

Assessing funding needs for early-stage cell therapy companies and the equity distribution among new investors and existing owners in these companies, constitute a critical challenge for stakeholders involved in creating successful companies around individual cell therapy projects. The BRITS tool provides stakeholders guidance in dealing with these challenges. Specifically:

– The cash flow statement produced by the tool helps stakeholders in assessing the funding needs associated with various development stages.

– The NPV calculation can be used to support negotiations surrounding the distribution of equity among investors and novel investors in cell therapy companies.

We use the case study of company X, which is seeking funding to develop a new allogeneic cell therapy in the oncology market space as a case study. The company completed preclinical studies and has regulatory approval to proceed with a phase I/IIa study to assess the therapy’s safety and to collect preliminary data on the therapy’s efficacy. In addition, managers use the following assumptions about the therapy they are developing and the commercialisation trajectory they will follow:

| The product and its market |

|

| Clinical trials costs |

|

| Manufacturing set-up costs |

|

| Staff costs |

|

| Fixed costs |

|

| Cost of capital |

|

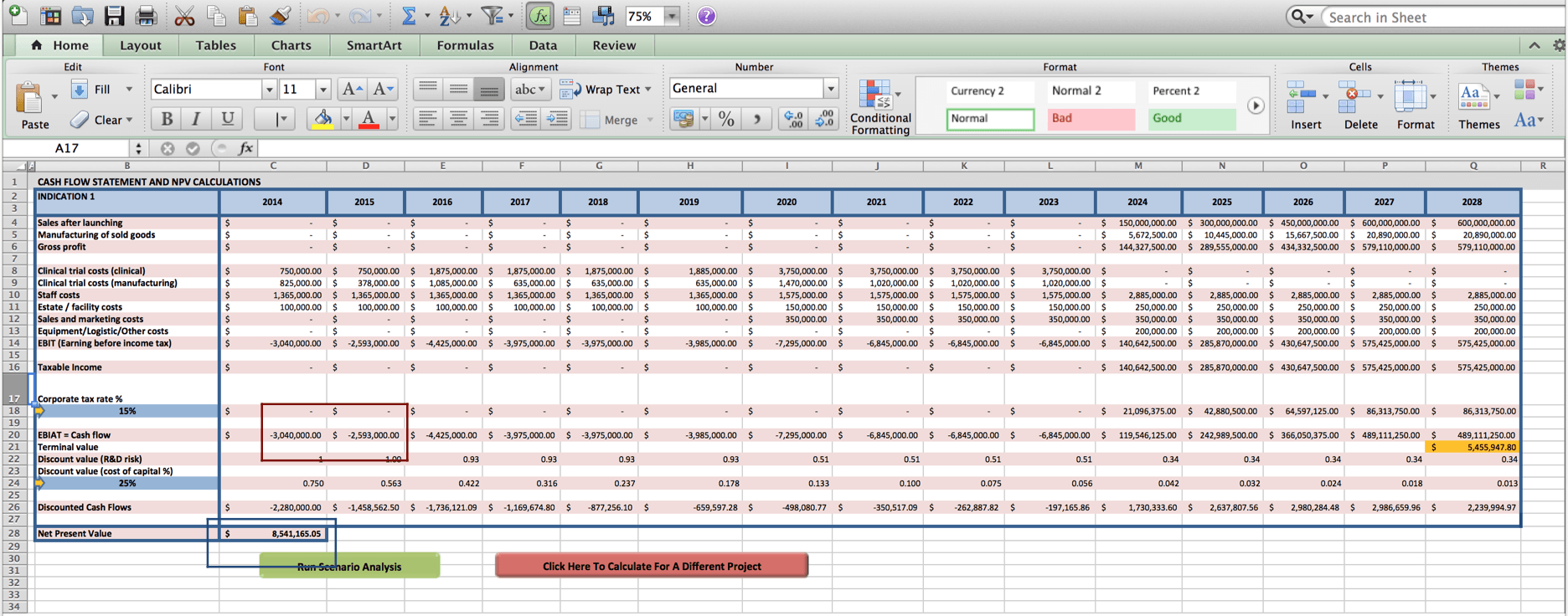

Using the inputs listed above, the tool produces the following cash flow statement that projects the financial in- and out- goings for the firm for the coming 15 years (see screenshot 1).

Assessing the firm’s development path and funding needs

Based on our data on allogeneic anti-cancer cell therapies entering phase 1/2a trials, we estimate that the duration of phase 1/2a trials will be 2 years, the duration of phase 2b trials will be 4 years, and the duration of phase 3 trials will be another 4 years (see costs boxed in red in Screenshot 2).

Row 20 consolidates all in- and out- goings and highlights yearly in- and out- goings in the form of Earnings Before Interest, After Tax (EBIAT). Adding up the projected outgoings during phase 1/2a trials, the tool projects a funding need of $3.0 Million + $2.6 Million = $5.6 Million (see costs boxed in red in Screenshot 3).

In addition, by adding up the discounted, risk-adjusted cash flow projections of row 28 in the spreadsheet, the tool provides a valuation for this cell therapy project of $8.5 Million (see amount boxed in blue in Screenshot 3).

Accordingly, a $5.6 Million investment to fund clinical trials 1/2a studies, would be worth a $5.6 Million/$8.5 Million = 67% ownership stake.

The tool allows stakeholders to play around with various assumptions underlying the firm’s business planning and assess the implications for these assumptions for the company’s funding needs, valuation, and equity distribution. One example would be for the firm from our example to arrange with managers and R&D workers that 50% of salaries will be paid in equity rather than cash during phase 1 clinical trials. This would significantly reduce the cash burn rate, and increase the valuation of the company. Screenshot 4 presents the cash flow statement and NPV for the same firm and assumptions as before, but reduces salary outgoings by 50% for managers and R&D workers during phase 1 clinical trials.

The revised funding need of the firm to finance clinical trials 1/2a is $2.5 Million + $2.0 Million = $4.5 Million, and the project valuation is $9.3 Million. Accordingly, the value of the $4.5 Million cash, investors would bring in is $4.5 Million/$9.3 Million = a 48% ownership stake.

In addition, the $562,500 of foregone yearly salary of managers and R&D workers for the two years that it will take to complete clinical trials 1 (calculated by subtracting from the amount in cell C10 of the baseline case cash flow statement, the amount in cell C10 of the cash flow statement in Screenshot 4), paid out in equity rather than in cash would be worth (2 x $562,500)/$9.3 Million = a 12% equity stake for these staff members.

Download the screenshots above:

Loading...

Loading...

56 Responses to “Case study 2: Dividing up equity”

- 1

- 2

-

3

harivanshtours wrote on 19 July 2023:

I expect to read great content like this every time I visit.

tempo traveller rental in jaipur -

4

galaxytoyota12 wrote on 3 October 2023:

Are you a proud owner of a Toyota Vehicle need of some TLC? Keeping your Toyota in tip-top shape is essential for both its longevity and your safety on the road. One crucial but often overlooked aspect is the windshield. A damaged or compromised windshield can be a serious safety hazard, compromising your vision and the structural integrity of your car. To ensure you’re driving with peace of mind, here are the top 5 signs that your Toyota car needs a windshield replacement service.

-

5

i need someone to write my assignment wrote on 4 October 2023:

Deciding how much cash is required and who gets a portion of the organization in the beginning phases of cell treatment new companies can be an extreme tough task. It’s a bit like handling complex financial matters If you ever find yourself stuck with an assignment on this topic, don’t hesitate to say, “I need someone to write my assignment.” Getting expert help can make things much easier on your academic journey.

-

6

Clair Banet wrote on 5 October 2023:

Once upon a time, in a world filled with exam worries, a hero named take my teas exam for me emerged. Accompanied by a team of scholarly knights, they set out on a mission to banish stress and bring about a renaissance of incredible grades. Join them on this journey, and craft your own success story.

-

7

marrontic wrote on 23 October 2023:

I really appreciate the developer’s investment in this game. Basketball Stars is both attractive with the stressful situation of pitching, as well as tactical and talented. This makes the game a great choice for basketball fans.

-

8

yati singhal wrote on 8 November 2023:

Dividing up equity is a crucial step in building a fair and successful venture. It’s fantastic to see collaboration and fairness at the heart of business! #EquityDistribution

-

9

Galaxy wrote on 20 November 2023:

Step into the Toyota showroom, where innovation meets elegance. A sleek fusion of cutting-edge automotive technology and timeless design awaits, showcasing a diverse array of vehicles that redefine the driving experience. Immerse yourself in a world of quality craftsmanship and eco-friendly options, as Toyota continues to drive the future of mobility with style and sustainability. Welcome to a showroom where every visit is a journey into the future of driving.

-

10

Used Cara wrote on 20 November 2023:

Unlock the road to affordable excellence with our curated selection of pre-loved vehicles. Our Buy Used Cars collection offers a gateway to quality, reliability, and savings. Each car tells a story, and we’re here to connect you with the perfect chapter. Embrace the journey with confidence, as our meticulously inspected and certified used cars redefine your drive. Your dream ride awaits, experienced and ready for new adventures.

-

11

TSG Used Cars wrote on 20 November 2023:

Discover the epitome of precision at Exact Price, your trusted destination to Buy Used Cars in Delhi. Unveil a curated selection of quality vehicles, each priced with meticulous accuracy. Experience seamless transactions and transparent dealings, ensuring you find not just a car, but a perfect match for your needs. Drive into a world where precision meets reliability, only at Exact Price.

-

12

Galaxy wrote on 20 November 2023:

Unveiling the epitome of automotive sophistication, the Toyota Legender Price and Features stands as a testament to luxury and performance. Priced with precision, the Toyota Legender seamlessly blends innovation and elegance. Its exact price mirrors the value of cutting-edge technology, unparalleled comfort, and a design that exudes modernity. Elevate your driving experience with the Toyota Legender – where every penny spent is an investment in automotive excellence.

-

13

สมัครหวยไทย wrote on 23 November 2023:

I read and found this article very interesting and useful. สมัครหวยไทย

-

14

Galaxy Toyota wrote on 29 November 2023:

Visit our Toyota Showroom for a premier automotive experience. Explore a stunning array of cutting-edge models, from sleek sedans to robust SUVs. Our showroom showcases Toyota’s latest innovations, providing a firsthand glimpse into unparalleled craftsmanship and advanced technology. Discover your ideal ride in a dynamic and welcoming environment.

-

15

empty 12 wrote on 29 November 2023:

Unlock unbeatable deals and explore a curated selection when you Buy Used Cars . Elevate your driving experience with a range of options that suit your lifestyle. From reliable classics to modern marvels, find the perfect match that aligns with your preferences and budget. Your dream car awaits in the world of used cars.

-

16

Auto Car Repair wrote on 6 December 2023:

Experience top-notch auto car repair services all under one roof at our multi-brand car service center. Our dedicated team of skilled technicians and mechanics is committed to providing comprehensive solutions for all your automotive needs. From routine maintenance to complex repairs, we specialize in delivering reliable and efficient services for a wide range of car brands. With state-of-the-art facilities and the latest diagnostic equipment, we ensure precision and accuracy in every repair. At our multi-brand car service center, your vehicle is in expert hands, receiving the care it deserves. Trust us to keep your car running smoothly and efficiently, ensuring you enjoy a safe and comfortable driving experience.

-

17

Hans Hyundai wrote on 6 December 2023:

The Grand i10 Nios, available at Hans Hyundai, seamlessly blends style, performance, and cutting-edge technology to redefine the driving experience. As a proud offering from the esteemed Hyundai lineup, the Grand i10 Nios exemplifies a perfect synergy of modern design and advanced features. Its dynamic exterior captures attention with sleek lines and a bold front grille, while the spacious and intelligently designed interior ensures comfort and convenience on every journey. Hans Hyundai, synonymous with excellence, showcases the Grand i10 Nios as a testament to Hyundai’s commitment to delivering innovation and reliability. With Hans Hyundai, customers not only gain access to this remarkable vehicle but also experience a customer-centric approach that prioritizes satisfaction and an unparalleled automotive journey.

-

18

Subhash Shastri wrote on 8 December 2023:

You have lots of great content that is helpful to gain more knowledge. Best wishes.

Get My Boyfriend Girlfriend Back By Astrology - 19

-

20

Dainik Astrology wrote on 8 December 2023:

Simply unadulterated brilliance from you here. I have never expected something not as much as this from you.

divorce problem solution -

21

harivansh tours wrote on 8 December 2023:

Thanks for sharing this great information, I would appreciate if you share this type of information regularly.

Travel Agency in Jaipur -

22

maharanacab wrote on 8 December 2023:

Wonderful job. I really enjoyed this blog of yours, Too cool to have like this. Hey pretty!! Thanks for posting, You have great blog here. keep it up.

Car Rental Service In Jaipur -

23

novelwebcreation wrote on 8 December 2023:

Thanks for sharing.I found a lot of interesting information here.

-

24

novelwebsolution wrote on 8 December 2023:

I really appreciate your post. Thanks for sharing this with us.

-

25

prontopanels wrote on 8 December 2023:

Your article has proved your hard work and experience you have got in this field.

- 26

-

27

Bolamd Thomas wrote on 11 December 2023:

Estoy muy contento de haber encontrado este gran sitio. ¡¡Debo agradecerte por tu tiempo por esta maravillosa lectura Definitivamente me gustó cada detalle y también lo tengo guardado como favorito para ver nueva información en su sitio.

Chicas Escort Merlo -

28

Elxan Məmmədov wrote on 28 December 2023:

Bank account management tools

Whether you have a private bank account or a corporate bank account for your business needs, it is essential to have convenient access to your funds and constant control over your account. However, sometimes you may be too busy to monitor your bank account, or you may be travelling, making your funds inaccessible when you need to make an urgent transfer… Fear not, for there are a number of different account management tools available that allow you to choose and create the most efficient and convenient account management model, no matter where you are.The three most common types of tools used to access and manage your bank account are:

Online banking

Using a personal banker

Authorising someone to manage your bank account for you -

29

Lorenza Smith wrote on 5 January 2024:

I love the plush insole and responsive midsole of on cloud shoes,that making every stride feel like a breeze. Perfect for long-distance running!

-

30

Micheal Lanther wrote on 6 January 2024:

A studded bb belt can add a hint of rebellion to an otherwise classic look.

-

31

Mary Taylor wrote on 8 January 2024:

Great article! Your insights and explanations are both informative and engaging. I appreciate the depth of your knowledge on the topic.

ghost writers uk online is a valuable resource for college students facing the challenges of dissecting real-world scenarios and academic analysis. Case studies often require critical thinking, in-depth research, and the ability to draw insightful conclusions. -

32

Miar34 wrote on 20 January 2024:

Identify potential challenges or undertale yellow conflicts that might arise from the chosen equity distribution.

-

33

Ctaherine N wrote on 25 January 2024:

I want to always read your blogs. I love them Are you also searching for nursing research paper help? we are the best solution for you. We are best known for delivering Nursing research paper writing services to students without having to break the bank

-

34

Nursing Writing Center wrote on 25 January 2024:

This is quite a .good blog. Keep sharing. I love them Are you also searching for Nursing Writing Center? we are the best solution for you. We are best known for delivering nursing writing services to students without having to break the bank.

-

35

dnp dissertation help online wrote on 25 January 2024:

Your blogs are fantastic. I love them Are you also searching for dnp dissertation help online ? we are the best solution for you.

-

36

tarun wrote on 5 February 2024:

I appreciate your meticulous research and the clarity with which you present complex ideas. Your writing not only informs but also captivates the reader’s attention. The real-world examples you provide make the content relatable and applicable.

DevOps Engineer Salary -

37

alexsss22022 wrote on 14 February 2024:

I enjoyed reading this .Thanks for sharing and keeping writing. It is good to read blogs like this.

Solo Leveling Costume -

38

jhon jimmy wrote on 14 February 2024:

Our hypnotic style trend is already making the up-to-date cities go wild with eager enthusiasm. And it is without question that the trendy involvement is from not just the quantity. But the gorgeous mingle of compact quality. Now you know your answer of what to pick among the industrious masses.

green shearling coat -

39

Emma Harriet wrote on 23 February 2024:

Disfruté leyendo esto. Gracias por compartir y sigue escribiendo. Es bueno Jujuy escorts leer blogs como este.

-

40

Mike Rooney wrote on 27 February 2024:

Thanks for posting such a great blog or article. It contains wonderful and helpful information. Keep up the good work!

5lbs of Pressure Jimmy Brown Jacket -

41

Tuskr App wrote on 11 March 2024:

Tuskr, a cutting-edge cloud-based test management software, revolutionizes testing processes within the SDLC with advanced features. Craft detailed test cases with ease, integrate seamlessly with chat and issue tracking systems, and enjoy robust security measures. Tuskr simplifies regression test runs and effortlessly generates comprehensive reports. Explore our free plan and flexible pricing options tailored for all team sizes. With Tuskr, experience streamlined test management throughout the SDLC. Enroll in your free trial today and witness the transformation of your testing processes with regression testing and other test management tools.

-

42

PPM Tools wrote on 12 March 2024:

In the realm of project management, finding a Smartsheet alternative that excels in features and usability is crucial. Enter Celoxis, a standout option renowned for surpassing Smartsheet’s capabilities. As a leading alternative, Celoxis offers a comprehensive suite of project management tools, seamlessly integrating task management, resource allocation, budget tracking, and reporting. Its intuitive interface and robust features make transitioning from Smartsheet effortless while providing enhanced functionalities for project oversight and collaboration. Celoxis emerges as the best Smartsheet alternative, empowering teams to streamline workflows, maximize efficiency, and achieve project success with unparalleled ease and effectiveness.

-

43

BSNS Consulting wrote on 13 March 2024:

Simplify your tax obligations with BSNS Consulting’s comprehensive Taxation Services. Our experienced tax professionals are well-versed in the intricacies of tax regulations, ensuring compliance while maximising your tax efficiency. Trust us to handle your tax planning, filing, and other tax-related matters, so you can focus on what matters most – growing your business.

-

44

Hardykohei wrote on 16 March 2024:

An impressive share! I’ve just forwarded this onto a friend who has been conducting a little homework on this.

And he in fact ordered me lunch because I stumbled upon it for him… lol. So allow me to reword this…. Thank YOU for the meal!! But yeah, thanx for spending the time to discuss this issue here on your blog.

-

45

Macleanflorian wrote on 16 March 2024:

I loved as much as you’ll receive carried out right here. The sketch is tasteful, your authored subject matter stylish. nonetheless, you command get got an nervousness over that you wish be delivering the following. unwell unquestionably come more formerly again since exactly the same nearly very often inside case you shield this increase.

-

46

Keatonkalya wrote on 16 March 2024:

Do you mind if I quote a couple of your articles as long as I provide credit and sources back to your weblog? My website is in the exact same area of interest as yours and my visitors would certainly benefit from a lot of the information you present here. Please let me know if this alright with you. Thank you!

-

47

Jeroenangela wrote on 18 March 2024:

Hey there I am so grateful I found your website, I really found you by mistake, while I was browsing on Digg for something else, Anyhow I am here now and would just like to say cheers for a marvelous post and a all round thrilling blog (I also love the theme/design), I don’t have time to look over it all at the minute but I have book-marked it and also added your RSS feeds, so when I have time I will be back to read a lot more, Please do keep up the great job.

-

48

TipTop Enrichtung wrote on 21 March 2024:

Transform your salon effortlessly with TipTop-Einrichtung’s comprehensive Friseursalon Einrichtung komplett. We specialise in offering hassle-free solutions to enhance your hairdressing space. Elevate your salon experience with our simple yet sophisticated complete furnishings.

- 49

-

50

sexy ทางเข้า wrote on 27 March 2024:

I gotta favorite this web site it seems very helpful handy sexy ทางเข้า

-

51

nhà cái uy tín dev wrote on 28 March 2024:

I appreciate the time and effort you invested in crafting such a thought-provoking piece. nhà cái uy tín dev

-

52

Diara Dominy wrote on 1 April 2024:

You can definitely see your skills in the work you write. The sector hopes for even more passionate writers such as you who are not afraid to say how they believe. At all times go after your heart.

-

53

Hardy Kohei wrote on 1 April 2024:

Hi there, just became aware of your blog through Google, and found that it is really informative.

I am gonna watch out for brussels. I will be grateful if you continue this in future. A lot of people will be benefited from your writing.

Cheers! -

54

ดาวน์โหลด ka slot wrote on 1 April 2024:

You are sharing a very informative and great post. ดาวน์โหลด ka slot

-

55

สมัคร แทง หวย บี wrote on 4 April 2024:

Your dedication to delivering high-quality content is evident in every word you write.

สมัคร แทง หวย บี - 56

Close

Close

When someone writes an article he/she maintains the image of a user in his/her brain that how a user can know it.

Therefore that’s why this paragraph is perfect. Thanks!