Brexit and FDI: Facts Checked

By Lisa Walters, on 7 June 2017

Dr Randolph Bruno, Senior Lecturer in Economics

The BREXIT debate, that we see unfolding within the UK parliament, the European Parliament, the media, British as well as international news outlets and more generally in public speeches on the campaign trail, is in many ways bewildering. It is in particular surprising that despite its importance it is very difficult to understand where each and every politician really stands on the issue of Brexit (e.g. http://www.bbc.co.uk/news/av/uk-politics-40088892/jeremy-paxman-grills-theresa-may-and-jeremy-corbyn). Negotiations strategies and possible outcomes remains very difficult to predict, as do the impact of the process on future relations with the EU . The confusion is further worsened by the circulation of alternative facts on social media, which may be contributing to a polarisation of views in society. The recent increase in hate crimes after the referendum is possibly one of the most worrying symptoms of these exacerbated social tensions.

A Polish family in Plymouth received what police described as a “hate-filled” letter.

There is thus a real need for actors on all sides of the debate (fierce Brexiteers or adamant Remainers) to look at the facts (yes the pure facts). Indeed, facts seem to have been too often missing from the debate before the referendum and are still hidden in small prints, almost non accessible documents or even those sometimes so transparent and accessible that nobody bother looking at them. This is a lost opportunity to let the audience (e.g. on the snap election campaign) or the politicians, (especially those directly involved in the forthcoming negotiations) to make truly informed decisions for the generations to come.

Where do we go from here? Well someone would argue that we should look at what the experts say. Academia? Policy-makers? Researchers? Think-tanks? These are fora where arguments have to be substantiated, verified and cross-checked with other facts/data, validated by peers. This post offers to clarify one dimension of the debate, by focusing on what we know of the effect of foreign direct investment (FDI) on the host economy and the potential impact of BREXIT on FDI.

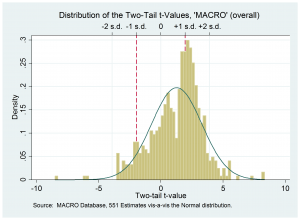

Regarding the effect of Foreign Direct Investment on the economy, our recent research on FDI is enlightening (Randolph Bruno, Nauro Campos and Saul Estrin Vox EU Column, 25/05/2017 “Gauging Globalisation”). On the one hand we have “Gauged Globalisation” by reviewing all the evidence available on the issue, and showing that FDI is indeed a key element behind the economic success of international countries; i.e. countries which aim to be plugged into the complex and potentially rewarding global value chain and international trade. We find that according to the vast majority of published work, FDI is a positive force, associated with better performance for domestic firms and better growth outcomes for the economy as a whole. This finding can be represented visually with the two distribution’s graphs below. Each bar represents how many studies (vis-à-vis all studies analysed) are located along the ‘effect’s spectrum’: the higher the bar, the larger the number of studies concurring on a specific point estimate; furthermore if the bar is located on the horizontal axis on a number higher than 0 then the effect is indeed positive, and vice versa for negatives one. The first graph is for the so called MICRO effect, i.e. how some foreign investment in a domestic company does impact the productivity of other domestic firms in the economy: we note that a positive nexus is measured by most researchers. The second graph provides even starker evidence: the MACRO effect entails the impact not only on domestic firms, but on the domestic economy as a whole. It is quite evident that the bars crowd the positive part of the axis. FDI is positively correlated with growth.

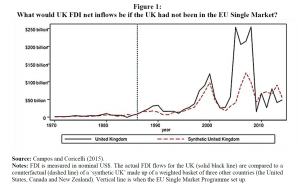

On the potential impact of BREXIT, we can present some findings from another publication (Randolph Bruno, Nauro Campos and Saul Estrin Meng Tian Vox EU Column, 05/05/2016 “The FDI premium from EU membership” and forthcoming book on The Economics of UK-EU Relationship, Palgrave McMillan A simple graph will again help us. The black line represents the quantity of FDI coming into UK each year according to official statistics (i.e. actual net flows), while the dotted line represents computed flows in an imaginary scenario assuming the UK decided to exit the European Union in 1986 (this is done using a “synthetic control”: by looking at the flows of actual FDI flows to countries that were similar to the UK in 1986 but never joined the EU). Well, the FDI would have been much lower.

Now reconcile the first result “FDI is good for growth especially at the MACRO level” and the second result “the UK FDI inflow was much greater thanks to EU membership”, and you get a simple conclusion: the UK could well be worse off by exiting the EU, at least as far as FDI and growth are concerned. Food for thought.

Close

Close