Financial Literacy Part 3: Are there socio-economic differences in how parents interact with their children about money?

By Blog Editor, on 11 February 2022

John Jerrim, UCL Social Research Institute

This blog post first appeared on the IOE blog.

In the previous blog post in this series, I investigated socio-economic differences in young people’s financial skills. This focused upon the types of financial questions that young people from advantaged backgrounds can successfully answer, that their peers from disadvantaged backgrounds can’t.

In this next post, I start to consider socio-economic differences in one of the key inputs into the development of young people’s financial skills – the role of their parents. Are there certain things that higher-income parents do with their offspring to nurture their financial skills, that lower-income parents do not?

Let’s take a look (with further details available in the academic paper here).

Differences in knowledge

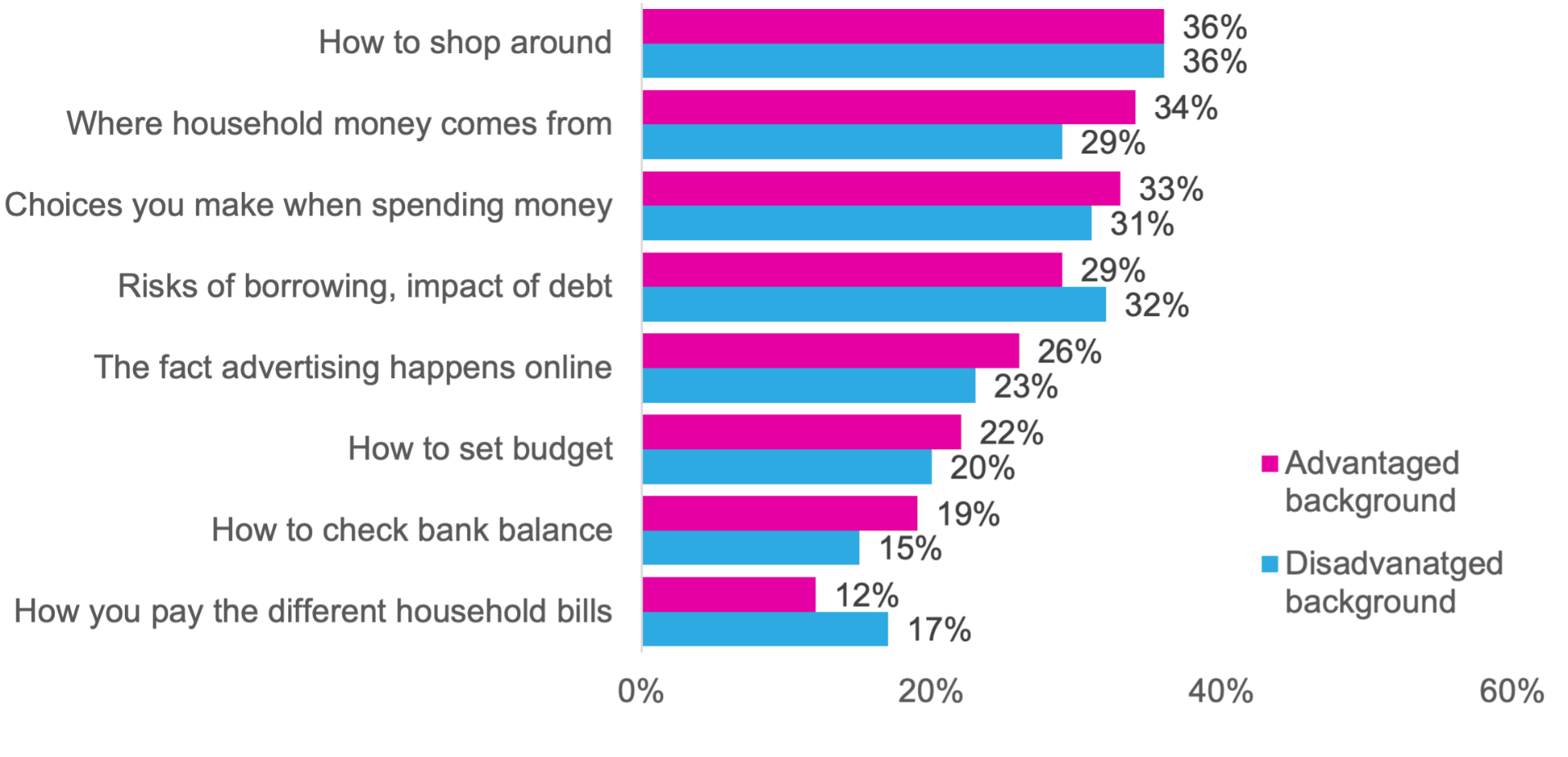

Figure 1 presents the percent of parents who say they do various financial activities “often” with their children, divided by socio-economic group.

Figure 1. Socio-economic differences in parent-child conversations and demonstrations of money use

Note: Figures refer to the percentage of parents who report that they “often” talk to or who show their child how to do the following things with money.

Although higher socio-economic parents are slightly more likely to regularly do most of the activities with their offspring, differences are generally quite small. For instance, although high socio-economic status parents are more likely to talk to their child about where their household money comes from than low socio-economic status parents (34% versus 29%) and the fact that advertising happens online (26% versus 23%) there is no difference in – for instance – showing their child how to shop around.

There are also certain areas that lower socio-economic status parents are more likely to talk to their children about, such as the risks of borrowing, the impact of debt, and how they pay for different household bills.

So, on the whole, socio-economic differences in the informal types of financial education parents provide their children are relatively muted. This point is reiterated by another finding from the survey – that the vast majority of parents recognise the importance of teaching their children about money, regardless of socio-economic background (see the top row of Table 1 below).

Where there does seem to be a notable socio-economic difference, however, is in parents’ confidence in their ability to effectively teach their children about money.

For instance, as Table 1 illustrates, more affluent parents tend to have greater confidence in being able to teach their child about how to manage money (65% versus 52%), that they can act as a good financial role model (65% versus 52%) and that they will be able to affect how their child will behave with money in the long-term (46% versus 37%), than disadvantaged parents.

Table 1. Socio-economic differences in parental views and confidence in teaching their children about money

| Disadvantaged background | Advantaged background | |

| % who believe it’s important to teach children about money | 85% | 88% |

| % very confident in talking to your child/children about how to manage money | 52% | 65% |

| % who strongly agree they can be a good role model for child around money | 32% | 47% |

| % who strongly believe they can affect how child will behave around money when they grow up. | 37% | 46% |

| % who don’t know how to talk to my child/children about money | 13% | 13% |

Now, such differences could either reflect that (a) higher socio-economic parents are indeed able to teach their children about money more effectively or (b) they are simply more confident in doing so.

Either way, any socio-economic gap in financial skills does not seem likely to be linked to the frequency with which high and low-income parents interact with their children about money – as they report having money conversations and conducting money demonstrations equally regularly. Rather, it seems more likely to be related to low-income parents’ ability to provide effective financial education to their offspring, either through a lack of skills or lacking in confidence to do so.

Close

Close