Machine Learning in Market Abuse Detection

By Lucy Thompson, on 12 December 2022

The world of finance is changing ever more quickly, thanks to the emergence of new technologies. Some of these changes are advantageous; the accelerated adoption of machine learning and AI is increasing efficiencies in risk and assessment, underwriting and claims processing. But technological developments also pose risks to financial institutions. Professor Fabrizio Lillo’s work with Consob, the Italian financial authority, is using machine learning for good, to detect instances of market abuse.

There are several different kinds of market abuse, loosely defined as the circumstances in which an investor in the financial market has been unreasonably disadvantaged directly or indirectly by others through their behaviour. These include price manipulation, spoofing and front running.

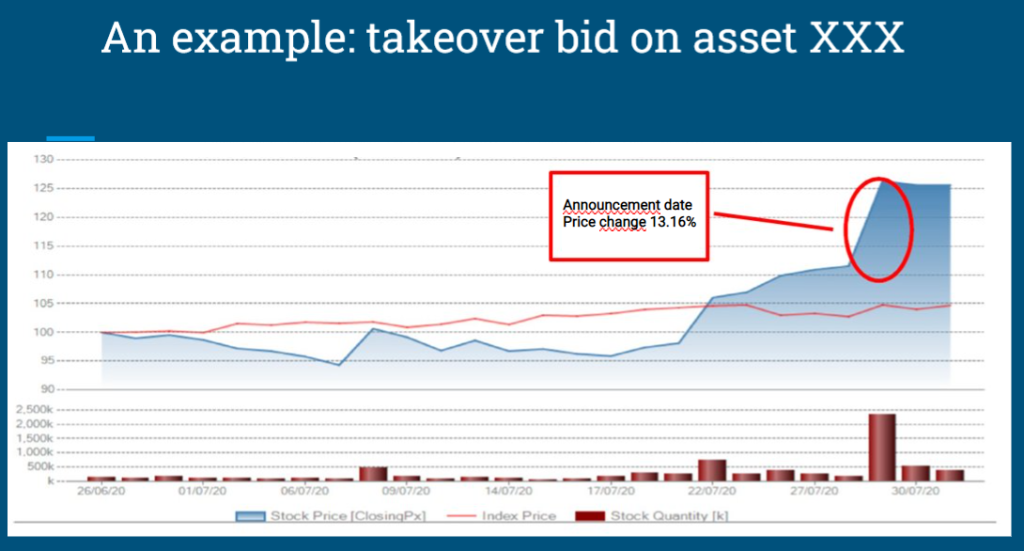

Lillo’s work focuses on instances where traders use information about a listed company that is not publicly available, a kind of market abuse known as insider trading. If traders are made aware of confidential information about a company in advance, it is then relatively easy for them to trade in a way that guarantees a profit. Typically, insider trading occurs around what is known as “price sensitive events” when a company makes an announcement – say, the appointment of a new CEO or a takeover bid. Access to this kind of information in advance of its announcement is strictly prohibited but it can occur, causing some investors to make larger, unfair profits in comparison to their peers. Instances of insider trading can be penalised throughout the world, but it’s often difficult to identify them.

Unsupervised ML methods to support surveillance

Unsupervised ML methods to support surveillance

Together with his co-authors, which includes IFT’s Director Prof Francesca Medda, Prof Lillo has been working with Consob on a wide-reaching digital transformation, which should improve operational, regulatory and supervisory processes. Improving regulation, particularly regulation technology or RegTech reduces the opportunities to conduct market abuse without detection. Lillo’s team have been testing machine learning methods that might support the detection of insider trading activities in particular. Over time, machine learning methodologies may indicate whether the behaviour of an investor or a group of investors is anomalous or, put another way, discontinuous with their usual investing behaviours. Here, discontinuity is defined in three different ways:

- Temporal discontinuity, e.g. buying uncharacteristically just before a price sensitive event occurs

- Discontinuity with ordinary behaviour of a group, e.g. an individual acting roguely when compared to their group

- Coordinated discontinuity, e.g. suspicious activity of an entire group just before a price sensitive event, which could suggest the spreading of information within a group

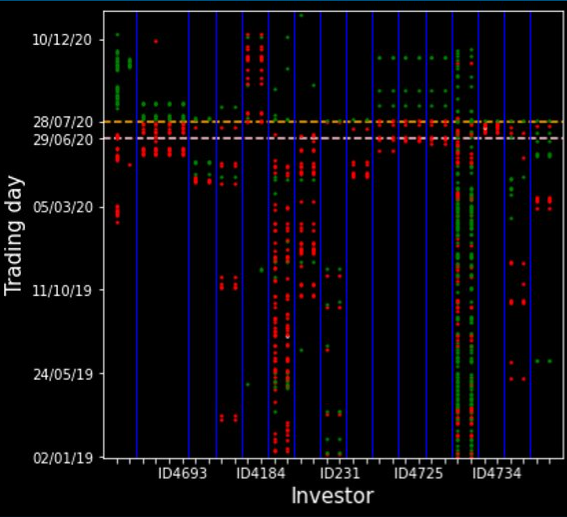

The first approach proposed uses clustering to identify, in the vicinity of a price sensitive event, discontinuities in the trading activity of an investor with respect to his or her peers. If an algorithm can be applied to track the investment activity of a group of colleagues over time, a cluster of investor engagement (buying, selling) of a certain stock around price sensitive events can be more easily identified. Comparing this engagement to other colleagues with similar behaviours over time can detect when an individual investor starts buying early, as if they have received a tip-off.

The second approach proposed aims in identify groups of investors that act coherently around price sensitive events. Say, for example, a group of synchronised traders all of a sudden displays strong directional trading in a rewarding direction, in the period right before a price sensitive event. These groupings may point to potential insider rings.

It is important to note here that while detection is important, it is not the end of the road – suspicious behaviour must be reviewed and investigated to ensure anomalous behaviour was not, simply, one-off good luck. Improved detection does not have increased prosecution as its goal. Rather, it is important to increase accountability and public confidence in the fairness of markets, as this improves their efficiency and liquidity. Market abuse can be harmful to market integrity and negatively impact the economy. As such, this work with Consob represents something with which authorities all over the world should engage.

Close

Close