Energy Market Reform for Renewables

By ucftmgr, on 18 November 2015

The UK’s Energy Market Reform was introduced for two main reasons: concern that inadequate private investment under the liberalized system was eroding the UK’s security of supply, and growing recognition that the existing system of Renewables Obligation Certificates (ROC) support was an inefficient way to support capital-intensive, low carbon investments like renewable energy. The EMR was intended to address these concerns. Contracts-for-Difference (CfDs), providing a long term fixed-price contract, were introduced to enhance investor confidence and thus reduce financing costs; CfDs were seen not only as a preferable way to support renewable energy, but also one applicable to nuclear energy. The Capacity Mechanism introduced fixed payments to all plants guaranteeing power available when needed.

The UK’s Energy Market Reform was introduced for two main reasons: concern that inadequate private investment under the liberalized system was eroding the UK’s security of supply, and growing recognition that the existing system of Renewables Obligation Certificates (ROC) support was an inefficient way to support capital-intensive, low carbon investments like renewable energy. The EMR was intended to address these concerns. Contracts-for-Difference (CfDs), providing a long term fixed-price contract, were introduced to enhance investor confidence and thus reduce financing costs; CfDs were seen not only as a preferable way to support renewable energy, but also one applicable to nuclear energy. The Capacity Mechanism introduced fixed payments to all plants guaranteeing power available when needed.

Following a first set of negotiated CfD contracts, the coalition proceeded to use competitive auctions, in December 2014 (for capacity contracts) and January 2015 (for CfD contracts). By most standards, this auction experience proved successful: the targeted volume under the Capacity Mechanism was procured for total system payment under £1bn (annual payment starting in 2018), much less than predicted, and prices under the CfD auctions proved substantially lower than the negotiated contracts prices the previous year.

Indeed, the Cambridge economist David Newbery (2015) estimated that the value of long-term confidence associated with the CfD contracts reduced the average weighted cost of capital by 3.3 percentage points compared to the previous ROCs system. If total low carbon investment over the next decade amounts to £60bn for example, this would imply a saving of around £2bn compared to the previous policy frameworks.

Challenges

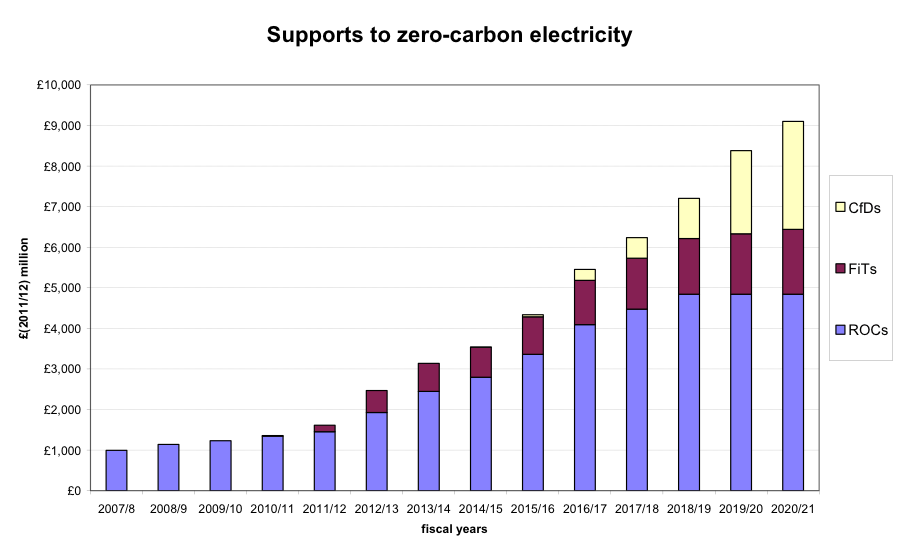

Despite the apparent effectiveness of the EMR package, the incoming government faced several challenges. The first was an obvious tension between its two main headline energy manifesto commitments, namely “to deliver clean energy as cheaply as possible”, and to “remove subsidies” from onshore wind energy, the cheapest large-scale renewable source. But the issue which grabbed the headlines within weeks of the government taking office, was that the renewable energy supports were breaching the Levy Control Framework, agreed with the Treasury to cap supports at £7.6bn/yr by 2020; projections for 2020 suggested that commitments already made or advanced in the pipeline would take the cost over £9bn (Figure 1).

Figure 1: Support costs for renewable energy to 2020.

Paradoxically, this partly reflected success due to the volume of renewable energy far exceeding expectations. Installed solar energy capacity by 2015 had grown to five times the level projected, at half the cost per unit. Wind turbines have also been producing more power than expected, in particular with higher load factors offshore. Both increase the volume of renewable energy receiving subsidies. At the same time, the Treasury’s earlier decision to freeze the carbon floor price, the subsidies to conventional power through the capacity mechanism, and the falling gas price have all combined to increase the bridge that CfD payments will have to span, to pay the contracted prices. To an important degree the cost overrun is a symptom of renewables success, but a failure of policy to plan for this.[1]

These two factors primed the stage for a major reset. In addition to the measures on energy efficiency and fiscal measures described in earlier blogs in this series, the government confirmed the removal of subsidies to onshore wind, shelved the CfD auctions due for later in 2015, and announced drastic cuts to feed-in-tariffs. The ‘reset’ had been launched with determination.

Policy needs to move forward, not backward. As Gross (2015) emphasises, investor confidence is partly about contracts, but also and crucially about the wider stability of policy direction. Ripping up the EMR is neither credible (the problems that led to it would merely be exacerbated), nor necessary (the sizeable cost savings from moving to long term contracts, already demonstrated, clearly support the manifesto commitment to deliver renewables as cheaply as possible). As Figure 1 illustrates, the cost overrun is mostly due to the policy support systems in place before the EMR came in. The reset is, however, an opportunity for further reform. The rest of this blog indicates some options.

What’s in a subsidy? A framework for fully mature renewables

The commitment to ‘remove subsidies’ for onshore wind, and progressively reduce those for others, begs an apparently simple question: what is a subsidy? That sounds like a simple question, but it is in fact fundamental. The key to continue expanding renewables whilst cutting subsidies is to understand that it about risk allocation and full-cost accounting.

In Brazil for example, in recent years wind has beaten fossil fuel generation in open competition, with no subsidy. Of course, land is cheaper and so are planning and permitting costs, but the real key lies elsewhere: how the system allocates the economic risks. Fossil fuel plants are relatively cheap to build, but expensive to run. Renewables are the opposite way round. Brazil auctions 20 year fixed-price contracts for electricity, which means that windfarms know exactly how much money they can generate, making them low risk and hence cheap to finance. Fossil fuel plants face the opposite risk, since they don’t know how much they may be needed or what their (fossil-fuel-driven) input costs will be.

UK and European electricity wholesale markets place price risks precisely the other way round. Fossil fuel generators largely set the price of electricity, including any carbon pricing; if renewables sell into this market they face the irony (and risk) that our wholesale market places the risks of fossil fuel (and carbon) price uncertainty on renewable energy generators, not on the fossil fuel plants. Hence the large savings in financing costs identified in Newbery’s analysis of the CfD auctions. And if CO2 is not properly priced, it is renewables that suffer.

The other big problem in defining subsidy concerns the extent to which environment and other ‘external’ costs are factored in to energy prices. A recent report of the IMF (2015) grabbed headlines by estimating that fossil fuels enjoy a whopping $5trn global subsidy. Others cried foul: the IMF was counting in ‘subsidy’ the unpaid cost of environmental damage they estimated from fossil fuel emissions, which dwarfed the direct financial subsidies. The UK already has its own way to estimate the damages associated with CO2 emissions: the Treasury, quite rightly, has an official ‘social cost of carbon’, which is used in government cost-benefit calculations and rises to £70/tCO2 by 2030.

The Brazilian model itself is not a realistic option for the UK energy market. If the new government wants to take onshore wind out of procured CfD auctions, it needs to find a way to separate subsidy from the legitimate value of long-term contracts and carbon reduction – unless it really intends to tilt the playing field directly against its expressed desire to deliver renewables as cheaply as possible.

So here is a modest proposal to consider, closely aligned to proposals for ‘carbon contracts’ by Helm (2004) and by Newbery (Grubb and Newbery 2006) a decade ago. A ‘subsidy-free CfD’ could be developed for new, unsubsidised onshore wind. The government would compensate the wind generators for any difference between the government ‘social cost of carbon’ (already established as its estimate of the cost of carbon damage) and the amount that fossil fuel generators actually pay for CO2 emissions. The Government would not be subsidising wind, but merely ensuring that wind generators gained the value already officially accorded to reducing CO2 emissions: at the Treasury social cost of carbon for 2030, the value of the CO2 displaced by renewable energy could be on the order of £30/MWh.[2]

Given the anaemic state of the European carbon pricing system and the freezing of the UK carbon price floor, no investor currently can rely on this value purely from wholesale market prices. Drawing on the demonstrated financial efficiency of contractual certainty, underwriting the carbon value in a long-term contract – a contract for difference on the carbon price, not the electricity price – would be the natural evolution to create a ‘subsidy free’ CfD. Moreover, it speaks to the governments emphasis on consumers, who could then choose to buy green in ways that really mean something. Wind energy investors will get the environmental value of saving emissions, as they should. And none of these will be subsidised. If and when the carbon price is sufficient to ensure that fossil fuel generators pay this cost, there would be no underwriting cost, just the carbon price revenues to government.

Containing costs and reflecting value

Whatever steps are taken regarding onshore wind, continued support for other renewables will be necessary to continue their industrial development and cost reductions and to help deliver the UK’s renewable energy and carbon targets. As the scale rises, containing the costs becomes ever more crucial. The government review of solar feed-in-tarrifs proposes to solve this problem with automatic degression of tariffs as the installed capacity rises, the solution recently adopted in Germany, assuming that FiTs are maintained (albeit at much reduced levels). If they are, history may well judge the changes to solar supports in particular as rationalisation, not politicisation – particularly if this is combined with a negotiated extension of the LCF to avoid the cliff-edge that renewables may otherwise face. For larger scale renewables, auctioning CfDs address directly the challenge of cost reduction through competitive pressures.

However the fact that the UK’s biggest resources are solar and wind (both onshore and offshore, considered in the blog in this series by McDowell and Smith) points to a crucial factor which is glaring by its absence from incentives in the EMR – namely concerning the variability of most renewables. They are available as the weather dictates, not when power is most needed. With renewable contributions at 20-30% of supply these costs are modest (Skea et al 2006), but as capacity rises higher, the economic impact of variability will become rapidly more important. DECC has launched a study of this, but the policy challenge will be how to reflect these costs efficiently in the incentives. One proposal – to force renewables into the capacity mechanism – would be a cure far worse than the problem.[3] But the challenge remains that the fixed price contracts of CfDs, whilst useful for enhancing investor confidence, fails to send any signals for more efficient choices of source and sites, or for the most efficient integration of renewable energy into the UK power system.

Both seasonal and shorter term patterns are relevant. Solar output in summer is several times that in the winter, and in the next few summers we will start to see the impact on the system when high solar output combines with low summer demand. Storage can help to alleviate this (though at a cost) but it cannot solve the seasonal disparity: average electricity demand is twice as high in the winter, a profile which wind energy matches well. Of course, wind energy is also variable, and there is value in more diverse deployment of windfarms to reduce the aggregate variations.

The CfD system of fixed payments does not incentive this; nor does it reflect the costs of fluctuations on the system imposed by wind and solar, which have to be managed. Moreover, by giving a fixed payment to all output, it risks over-paying the best sites, and projects which substantially out-perform expectations (as with the recent offshore wind experience).

To address the last of these problems, Newbery (2015) suggests payments based on installed capacity (rather than actual output) or capped at a certain level of output.[4] A related idea might help also to start reflecting some other aspects of variable output. The wholesale electricity price reflects the cost of conventional generation at a given time, and as the capacity of renewables rises (and as capacity margins tighten), variations in renewable energy output will increasingly also impact the wholesale price, and prices in the balancing mechanism which matches supply and demand over short periods. CfD contracts could be paid on a basis of “deemed output” – notionally, an average expected output – with payments then being adjusted according to the actual wholesale value of the power generated at a given time (for an example, see Annex to the final report from this series). This would preserve much of the investment efficiency properties of the existing CfD contracts, but adjust it with reference to the actual dynamic value of the renewable output in the system operation.

Conclusions

The first of the ‘four simple steps to maintain investor confidence ..’ suggested by Gross (2015) is to ‘provide longer term clarity and continuity’. This is a difficult balancing act, since policy also needs to learn from experience and evolve. Some of the suggestions in this policy blog could take a long time to work through in detail. The government has already aborted the Renewable Obligations for onshore wind from 2016 and signalled a move to FiTs with automatic degression, in the light of the LCF overshoot. The happier side of this, however, is that the volume of renewables being contracted is already close to the initially targeted contribution of electricity to the overall renewables 2020 target. This contrasts sharply with the heat and transport sectors, where progress has proved more difficult.

Angela Rudd’s recent reassertion of the renewables target, set as legally binding precisely to enhance investor confidence, would appear to set the context for rationalisation, which could include a higher share of renewable electricity if deployment continues. There is a strong case for pressing ahead with the next round of both Capacity auctions, to ensure security, and another round of CfD auctions, to help maintain industrial momentum and deliver the 2020 renewables target, and to buy time for deeper reforms needed for the post 2020 era.

This blog has indicated that there are solutions to the longer term challenges. In addressing these problems creatively and reasserting the renewables target, the government has the opportunity to make important improvements to the EMR whilst preserving its essential features: to go forwards, with a more efficient supporting framework for renewables, rather than backwards. If the government is serious about the ‘hard reset’ being a rationalisation of UK energy policy consistent with our renewable energy and carbon targets, whilst restoring confidence to the industry, there is valuable scope to do so.

Prof Michael Grubb is Professor of International Energy and Climate Change Policy at the UCL Institute for Sustainable Resources

Notes:

[1] It reflected a classic tendency to underestimate economics of scale and innovation in improving performance – a common inability to recognise the central importance of ‘Third Domain’ economic processes in the energy transition (Grubb, Hourcade and Neuhoff 2014, 2015). The flaw in the EMR was not failure to anticipate the future, but to not be robust to its uncertainties: most notably, to fix feed-in tariffs and the Levy Control Framework without the flexibility required to cope with unexpected success. Moreover the fixed FiTs with periodic revision were intrinsically vulnerable to this kind of miscalculation; moreover, with periodic revisions leading to unpredictable degrees of tariff reductions, they also tended to lead to a rush of investments before the deadlines.

[2] As well as the carbon price, the value depends upon the carbon intensity of the fuel displaced by renewable generation. If this is taken as an advanced gas plant at 400 gCO2/kWh, this equates to £28/MWh. If there is any coal still on the system, the value would be substantially higher. Even if the EU ETS were to remain anaemic and the UK carbon floor price remained close to its present level, the cost differential underwritten by government in such contracts would be about £20/MWh. For comparison the clearing price for wind in the last CfD auction was around £80/MWh.

[3] Helm’s (2015) suggestion that renewables support should be transferred to the capacity mechanism would be fantastically inefficient, since it would require individual renewable projects to have their own backup rather than pool backup capacity for the system overall – losing both the benefits of source diversity and leading to huge redundancy in ‘backup’ investments. It would be logically analogous to expecting the UK system to have enough capacity to insure against the possibility of every kettle and other appliance being on at the same time – at vast expense for redundant ‘backup’ capacity that is never needed.

[4] Newbery (2015) offers a number of other suggestions for improving the CfD structure, including that contracts should be denominated in nominal rather than indexed-linked payments; this would also be important to facilitate the tradability of long term renewable energy contracts.

References

Climate Change Committee (2008), Building a low carbon economy – the UK’s contribution to tackling climate change.

Gross R. (2015), “Driving innovation through continuity in UK energy policy: four simple steps”, Policy Brief, Imperial College London

Grubb, Hourcade and Neuhoff (2014), “Planetary Economics: Energy, Climate change and the Three Domains of Sustainable Economic Development”, Routledge, London

Grubb, Hourcade and Neuhoff (2015), ‘The Three Domains Structure of Energy Transitions’, in Technology Forecasting and Social Change, discusses briefly the PV example.

Helm D. (2015) , The First 100 days of Conservative energy policy, http://www.dieterhelm.co.uk/node/1410

Helm D. (2015), Reforming the FiTs and capacity mechanisms: the two-stage capacity auction, Energy Future Network paper no.14

Helm D. (2004) Energy, the State and the Market, OUP.

International Monetary Fund (2015), ‘How Large Are Global Energy Subsidies?’ IMF Working paper WP/15/105, available at https://www.imf.org/external/pubs/ft/wp/2015/wp15105.pd

Newbery D. (2015), “Reforming UK energy policy to live within its means”, EPRG Working Paper 1516, available at http://www.eprg.group.cam.ac.uk/wp-content/uploads/2015/09/1516-PDF.pdf

Grubb and Newbery (2006), chapter in Grubb, Jamasb and Pollitt (2006), Delivering a low carbon electricity system: technologies, economies and policy, CUP

Ofgem (2009) Project Discovery, available at www.ofgem.gov.uk

Skea et al (2006) The costs and impacts of intermittency, Reports I and II, UK Energy Research Centre, http://www.uwig.org/0604_Intermittency_report_final.pdf

One Response to “Energy Market Reform for Renewables”

- 1

Close

Close

[…] A cynic or conspiracy theorist might suspect that the lack of urgency in proceeding to a second CfD auction may not be unrelated to the UK Government’s reluctance to put itself – in advance of a referendum on the UK’s continued membership of the EU – in the position of appearing to have to ask the Commission’s permission (in the form of a state aid clearance for alterations to the CfD rules) not to offer CfDs to technologies that Ministers do not want to subsidise. But cynics and conspiracy theorists are often wrong. The Government is perhaps more likely to be just taking its time to consider the future of CfDs more broadly. For example, in the 11 February 2016 Parliamentary exchanges referred to above, Ministers confirmed that they are looking “very closely” at the seductively labelled and highly fashionable concept of “subsidy-free CfDs” (which means different things to different people, but for one interesting suggestion, see this blog post by Professor Michael Grubb of UCL). […]