Internalizing External Debt

By Lauren Bonilla, on 24 February 2016

This is the final blog post in our series about loans and debt.

“Did you read the news about Oyu Tolgoi?”, asked Ganzorig between sips of green tea. Assuming that his question referred to the news announced the previous day that the Mongolian government signed a major financing agreement to begin development of the underground section of the Oyu Tolgoi copper-gold deposit in Omnogobi province, I replied, “Yes, it’s big news for Mongolia.”

Ganzorig exhaled sharply and shook his head, remarking in a dispirited tone, “It’s not so good for us.” His negative response took me by surprise. In the twelve years Ganzorig and I have been friends, he has had a consistently optimistic attitude towards Oyu Tolgoi and its contribution to his country’s development. When I asked Ganzorig why the deal was not good, he clarified his sentiments:

It’s another loan. It’s like 4 billion American dollars, right? How can we repay this? Uh, there are too many loans!

Later that day, I met with a former colleague working in the tourism industry who, like Ganzorig, brought up the news about Oyu Tolgoi and was quick to criticize it. She lamented, “My country will pay more for loans than become rich from Oyu Tolgoi!”

These were offhand comments made by friends in casual conversations, yet I think they reveal something significant that is forming in the minds of many Mongolians around the rising indebtedness of their country.

A New Debt Landscape

In 2011 and 2012, when I conducted research on the growth of the mining industry, I heard little public discussion about debt and loans in relation to the mining industry and the national economy more broadly. Of course, mining companies at the time were engaged in a wide range of official and unofficial lending practices to finance operations, and there were important discussions between companies (both foreign and domestic) and the government about who should bear the responsibility of financing mining projects and ancillary infrastructures.[1] However, in interviews with a number of diverse Mongolians living in different regions of the country, I found that people were more interested in the then hot-topic of national equity ownership in mining projects like Oyu Tolgoi than about the loans required to make such projects possible.

When I returned to Mongolia in the fall, I observed how discussion about national-level debts filled evening news programs, came up in crowded jeep rides across the countryside, and figured into intimate conversations among family and friends. Far from being an abstract issue for government and economic policy, ‘foreign debt’ (gadaad ör) and ‘national/state debt’ (ulsyn/töriin ör) appears to be becoming internalized in people’s lives as a new economic reality and a subject of collective concern.[2]

The Chinggis Bond Effect

Rising public awareness of national-level debts reveals how Mongolia’s relationship with debt has changed in recent years. In 2012, the Mongolian government acquired its first sovereign bond, nicknamed the ‘Chinggis Bond’. Sold as a five- and ten-year bond, it garnered US$1.5 billion, far more than was initially anticipated. A year later, the Development Bank of Mongolia issued a ¥30 billion 10-year ‘Samurai Bond’ in Japan. The word ‘bond’ has since become normalized in colloquial Mongolian, referring specifically to a loan financed by investors on international markets. More generally, and perhaps significantly, bond is also used to refer to debt that Mongolia, as a nation, owes to foreigners.

The debts raised by the two sovereign bonds are small in comparison to the national debts of other nations – a point Mongolian politicians and economists commonly make. Their significance, though, is compounded by other external debts acquired by the government and companies, especially miners. The timing of this debt accumulation is significant, as it has occurred not in a period of growth but amid the slowdown of the Chinese economy and the global commodity cycle, two interrelated dynamics to which Mongolia is exceptionally exposed. According to a report published in November by Fitch, Mongolia now has the second highest external debt to GDP ratio in the world at 129.8%, representing some $22 billion.[3]

Personal as National Debt

This amount of debt could feel distant to an individual, like how, as an American, the US national debt of $16.3 trillion feels to me. However, I think that many Mongolians can relate to this debt because it reflects the indebtedness they feel in their own life, albeit on a much larger scale.

When Ganzorig expressed to me that there are “too many loans,” he was directly commenting on the large amount of foreign debt his country was accumulating. Knowing Ganzorig well, I could also hear the words reflecting his frustration with living a life where he is constantly swapping one loan for the next, slowly building more and more debts in the process.

Ganzorig struggles to operate a small electrical business in Ulaanbaatar, often relying on small loans, barter, and gifts from friends to get projects done. He could not get a business loan from a bank because he had no office property to serve as collateral. He could not acquire an office because he is already plagued with stress and sleepless nights about how to pay a hefty monthly mortgage on an apartment he bought a couple years ago through the 8% mortgage scheme. Additionally, following the government’s adoption of a new tax law last August to get tax revenues from businesses, Ganzorig has been under pressure to pay taxes he did not know he owed to a local municipality.

He described to me how any money coming to him feels like it goes “undigested” (shingeegüi): it runs right through him like his stomach was upset, thereby providing him no nutritional gain. Any “profit” (ashig) goes “to the bank” through interest payments, allowing a small group of elites to “keep money in their pockets.”[4]

Moreover, for someone like Ganzorig whose everyday life is already shaped by chains of debt, national debt might feel like yet another link that weighs the chain down. Yet it is a link that is not necessarily of one’s choosing, given that debt like the Chinggis Bond is classified as ‘public property‘ (ard tümnii ömch) to be repaid through taxes and the state budget.

Undigested Debt

Given the public ownership of bond monies, how the monies have been spent since 2012 has been a topic of controversy. Originally, the bonds were meant to finance national development projects, like the construction of roads and bridges, the building of factories, the improvement in energy and electrical infrastructures, and the financing of small enterprises. The government stated that it planned to use the Chinggis Bond to fund 888 projects, a number that my research partner, G. Munkherdene, explained to me, “Was chosen because of its spiritual importance…it was seen as lucky.”

Rumors and conspiracy theories abound about how the allocation of bond monies was based on political and business alliances and secret deals instead of transparent and egalitarian tender processes. Indeed, when the majority of politicians are also involved in private businesses – a phenomenon Bum-Ochir Dulam explored in his post on the mortgage market – any government-backed economic project appears suspicious.

‘Big Money Carries Big Risk’ (Ersdel Dallah Ih Möngö). The barren trees represent the Chinggis (left) and Samurai (right) bonds. Source: www.mongolianeconomy.mn.

In Ulaanbaatar, my friends point out features of the urban landscape that they associate with the bonds: smiling faces painted on sewer covers, empty apartment buildings, new roads and bridges, and pedestrian cross walks. In rural western Mongolia, people also pointed out similar new features in their district center that they thought were built with government-backed ‘projects’ (tösöl) funded by the Chinggis bond. While these improvements seemed welcomed, people wondered about where the rest of the bond monies have disappeared and why long-term things that would make Mongolia more productive in the future (heregtei yum) – like better hospitals and schools, and more domestic industry and jobs – have not been developed. A smiling face on a sewer cover does little to help someone pay their own debts, let alone the nation’s.

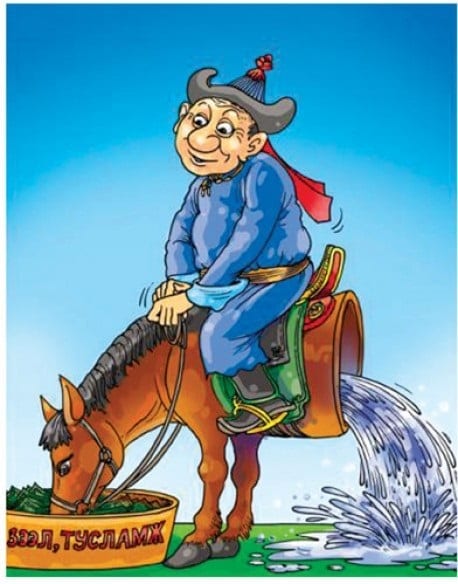

A horse eats loan (zeel) and aid (tuslamj) money from a bowl, which goes undigested. Source: http://gereg.mn/news/9059/

‘#Hyamral #Hyamdral #Hyatad’

In November, Khongorzul Bat-Ireedui, a rising public figure in Mongolia, posted the following message to her many followers on Facebook and Twitter:

2016 GDP expectations: #Crisis #Discount #China (#Hyamral #Hyamdral #Hyatad). Source: www.facebook.com/khongorzul.batireedui https://twitter.com/khongorzulb

The message about GDP growth and the clever alliteration of words at the bottom, which can be translated as #crisis #sale #China, reflects the kind of grim expectations Mongolians have for 2016.

The IMF/World Bank warns that Mongolia is at risk of ‘debt distress’ because of its mounting external debts, declining foreign investment and revenues from mining, and looming debt repayments. In 2017, $500 million from the Chinggis bond and a $580 million government-guaranteed bond through the Development Bank of Mongolia are owed to creditors. US$2.4 billion from a three-year currency swap with the People’s Bank of China is also due, though this is anticipated to be extended into the future.[5] Given the widely discussed lack of liquidity in Mongolia, how these debt are to be repaid is contested and uncertain (see here and here).

Since Ch. Saihanbileg became Prime Minister in November 2014, the government has declared that there is now an ‘economic crisis’ (ediin zasgiin hyamral) in Mongolia that must be managed. ‘Debt distress’ is part of the crisis, but there are also wider economic challenges that Mongolians are feeling in very tangible ways. The value of the Mongolian tögrög is regularly hitting new historic lows, herders are selling animal meat and skins at the worst prices in memory, salaries have been cut or suspended across a number of sectors, and people have lost jobs amid the retreat of foreign investors. If you get into a taxi cab in Ulaanbaatar and ask the driver about the economy – he or she will very likely describe it to you as hyamral, a crisis.

It seems, too, that the language of crisis has as much to do with future expectations as about the current condition. Khongorzul may be suggesting this by flagging the words “discount” and “China”, given that there is widespread anticipation – and outright fear – that the Mongolian government will address its debt distress by giving away its mineral wealth to China for little or nothing in return for financial assistance.

National ‘Bonding’

These dynamics paint quite a negative picture for 2016. Mongolian astrologers are calling this new lunar year of the fire monkey ‘evil faced’ (muu nüürt or nüür muut) because it is expected to bring low precipitation and poor forage for livestock, and an increase in political struggles and poverty, among other things. The upcoming parliamentary election this summer also adds weight to the year, as election seasons are often times when much happens and is promised.

It will be important to watch how Mongolian politicians address the issue of debt this year. There are some individuals who seek to make the looming debt repayments seem less severe and manageable, whereas others seek to increase public awareness about their size and significance. Either way, it is a highly politicized field.

Moreover, how ordinary Mongolians negotiate national debt is perhaps an even more interesting question. As my colleague, Bum-Ochir Dulam, put it while we chatted about this topic in our office at UCL:

We [Mongolians] are all socially bonded by the Chinggis Bond. I have debt, our nation has debt, we all have debt.

It is not only that so many Mongolians carry personal debts, but that individuals feel that they share in the responsibility of repaying national debts. This responsibility may take the form of austerity measures, like increased taxation, budget cuts, and job losses. Or it may be more direct, such as the government calculating the amount of national debt to be allocated to every Mongolian, even newborn children – a scheme that is reputedly underway. Mongolians are also concerned that they will be implicated in governmental actions that they personally oppose and which might affect the fortune and future of their nation. For instance, subsoil wealth, like the gold deposits near Noyon Uul, may be extracted not for development purposes, but to pay off debts to foreigners.

A Space for New Citizen Politics?

Our blog series has documented the pervasiveness of loans and debt in Mongolia. While lending practices and debts are not necessarily seen as negative, and can even help build new forms of sociality and economic possibility, the cumulative impact of personal, business, and national debts is uncertain.

As seen in other places where rising national and personal debts have become touchstone issues, debt can be a galvanizing societal force that can lead to popular uprisings, movements, and regime changes. In Mongolia, where the government has never had to be dependent on nor be accountable to citizens through public taxation, given its access to other revenue streams, the shared experience of being ‘collective owners’ of national debt may open the space for new forms of citizen politics. Mongolians may question their entanglement in their nation’s debts – which they never asked for in the first place – and why they and perhaps future generations should bear the debt burden.

Conversations about debt with my research partners, Sh. Tuya and G. Munkherdene, contributed to this post.

[1] Domestic and foreign companies commonly viewed the government as seeking to bear as little debt as possible.

[2] ‘Foreign debt’ and ‘national/state debt’ are sometimes used interchangeably in Mongolia. Foreign debt can include both public and private debts obtained abroad. National/state debt refers to monies which the government has borrowed (which, in the case of Mongolia, is primarily sourced abroad). When the government borrows money externally through a bond, the debt is known as sovereign debt. For simplicity and to reflect how Mongolians themselves commonly talk about national-level debts, I use ‘national debt’ in this blog post.

[3] It is difficult to find consistent figures of Mongolia’s total external debt. Different entities in Mongolia like the Ministry of Finance, researchers, politicians, and the IMF/World Bank classify national debt using different metrics. For instance, some calculate currency swaps as part of state debt, whereas others do not. Mongolia revised its Debt Management Plan in 2015 in an attempt to clarify the issue.

[4] Someone who “keeps money in their pocket” is often seen in a negative light as ‘stingy’ (haramch). Someone who redistributes personal monies through loans or gifts to friends and relatives is a characteristic of a ‘good person’ (sain hün).

[5] Data on the amount of this currency swap varies. In a parliamentary meeting, the value was put at $1.9 billion.

241 Responses to “Internalizing External Debt”

- 1

-

2

Rebecca Empson wrote on 4 March 2016:

Dear Lauren, thanks for this insightful post. I wonder if you could elaborate a little on the interesting points you raise at the end. The fact that people are now ‘collective owners’ of national debt seems, in your account, to contrast with the notion of ‘collective ownership’ based on contributions through taxation. I wonder in what sense these different kinds of ownership, or contribution to the state, open up the space for different kinds of engagement and politics? It seems that you might be suggesting that entanglement through debt opens up the space for critical protest, whereas asking nations to account for policies which one has contributed to through taxation opens up the space for a different kind of political engagement?

-

3

EE wrote on 14 March 2016:

This analysis looks at the issue from a very different perspective on social and environmental impacts. Excellent!

-

4

Гадаад өрийг дотоодчлох нь | Шинжээч – Үндэстний Сэргэн Мандлын Сүлжээ wrote on 26 July 2016:

[…] Ингээд би 2015 оны намар Монголд ирээд, улсын хэмжээний өрийн талаарх хэлэлцүүлэг нь өдөр тутмын мэдээний нэвтрүүлгийг дүүргэж, хөдөө орон нутгаар хэрэн хэсэх машинуудад чихцэлдэн суусан зорчигчдын ярианы сэдэв болж, гэр бүл, найз нөхдийн дотно ярианд хүртэл орж ирж байхыг анзаарсан юм. Эдийн засгийн хийгээд төр засгийн бодлогод хийсвэр асуудал байхаа аль хэдийн больсон гадаад өр болон улсын/төрийн өр нь эдийн засгийн шинэ нөхцөл байдал, олон нийтийн санаа зовох асуудал маягаар хүмүүсийн амьдралд нэвтрэн орж ирж буй нь илхэн. [2] […]

-

5

“Shakhaanii Business”: Shared Debt, Privatization of Profit, and (Re-)Emergent Corruption Discourses in Mongolia | UCL Emerging Subjects Blog wrote on 2 March 2017:

[…] elections have become foci of interrelated concerns, controversies, and conspiracy formation about national debt, national development, and international mining projects, long noted and discussed on this […]

-

6

Revisiting History: Debt and Protest during the Manchu Period | UCL Emerging Subjects Blog wrote on 15 May 2017:

[…] politicians’) debt by sharing and distributing it amongst themselves (see also Marissa Smith and Lauren Bonilla’s blog posts), as their politicians accrue more debt through the misuse of monies. However, the […]

-

7

katvinsharma wrote on 23 February 2023:

I am Katvin, a recently single married woman who is looking For a safe and sane man to meet to satisfy my needs. Connaught Place Escorts Service

-

8

Vartikasinha wrote on 23 February 2023:

Are you Looking For Vasant Kunj Escorts? They have an hourglass figure and I love to flaunt it. They Are ready to give you the best time of your life.

-

9

aliyaroy wrote on 23 February 2023:

Book now Malviya Nagar Escorts are some of the most highly-rated agencies in Delhi.

-

10

Uttam Nagar Escorts wrote on 23 February 2023:

Do you want physical service without any fear in Delhi who is to make your night Memorable which you not want to forget so choose Uttam Nagar Escorts missdelhi Agency girls and women are ho sexy, and they are having good figure which is seduce in bed so hire now and enjoy girls are available all days more visit website:-

- 11

-

12

nisha gupta wrote on 24 February 2023:

I was seeking for a post like this, roulette Finally reading about the Thank you so much makes me very pleased. Your article was very beneficial to me. Visit my website if you’re interested in the column I wrote.

Call Girl in Lucknow Justdial contact Number -

13

Lakhnow Call Girl wrote on 24 February 2023:

I appreciate your amazing article. It has long been quite beneficial. Thanks for sharing this content, I hope you’ll continue to share your knowledge with us.

- 14

- 15

-

16

Dewataspin wrote on 25 February 2023:

Dewataspin is a slot game that is always an option in slot games Dewataspin Online is widely used by bettors as a place to bet.

-

17

Gaspoll88 wrote on 25 February 2023:

Gaspoll88 is Slot online indonesia the best undeductible credit deposit that provides trusted online slot games with the highest RTP in Indonesia.

-

18

Gigaspin88 wrote on 25 February 2023:

Gigaspin88 the first agent for Slot Gacor Hari Ini in Indonesia, to make it easier for members to make transactions now.

-

19

Jayaspin wrote on 25 February 2023:

Pragmatic play is one of the most well-known Slot Gacor Hari ini and is the best slot game both in Indonesia and internationally.Pragmatic Play is the best recommendation for you and won the most complete best of online slots award of all time.

-

20

Kudabet wrote on 25 February 2023:

Kudabet is The Most Trusted Agen Slot Tergacor Di Indonesia which is a type of provider that is easy to play.

-

21

Truckabuses.com wrote on 25 February 2023:

Great article, I really like your post. you keep posting like this

Tata ace ht plus price -

22

Sebastian Ceb wrote on 27 February 2023:

The game has been designed by the team at PG Slot, who are also responsible for designing and developing the game.

The team consists of experienced developers, designers, and marketers with backgrounds in blockchain technology, gaming development, and marketing. -

23

cryptorobotics wrote on 27 February 2023:

Users are allowed to register 4 types of accounts:

*Starter. This type of account allows users to trade on the margin market, deposit and withdraw funds in crypto, buy, sell and exchange cryptocurrency).

*Express. Availability of such an account allows users to deposit cash – $9k lifetime limit, withdraw cash – $9k monthly limit, and exchange funds – unlimited.

*Intermediate. This type of account includes all the features of the basic account, as well as buying, selling, exchanging regular money, withdrawing, trading crypto futures, depositing and withdrawing funds in fiat, and high transfer limits.

*Pro. Everything is included as in an average account plus individual transfer limits, trading with the largest leverage in the margin market, high API limits, and OTC crypto trading. -

24

baccaratsite wrote on 28 February 2023:

It’s really great. Thank you for providing a quality article. There is something you might be interested in. Do you know baccaratsite ? If you have more questions, please come to my site and check it out!

- 25

-

26

williamsmith wrote on 28 February 2023:

The UAE is a thriving hub for businesses in the Middle East, making it an ideal location for commercial property rentals. Here are some important factors to consider when looking for commercial property for rent in the UAE:

commercial property is a critical factor to consider when renting in the UAE commercial property for rent in uae You need to look for a location that is easily accessible by your target audience and is close to key transportation hubs, such as airports or major highways. It is also important to consider the proximity to amenities, such as restaurants, cafes, and retail outlets, that can add convenience to your business operations.

Space Requirements: The size and layout of the commercial property should be in line with your business requirements. You need to evaluate your space requirements and the type of business you operate to ensure that the space you rent is suitable for your needs.

Rental Price: Rental prices for commercial properties in the UAE can vary depending on the location, size, and amenities of the property. It is important to set a budget for your rental expenses and look for a property that is within your budget.

Amenities and Facilities: The UAE is known for its modern and state-of-the-art commercial properties with a variety of amenities and facilities. When looking for a commercial property for rent, it is important to consider the amenities and facilities provided by the property owner, such as parking facilities, access to high-speed internet, meeting rooms, and security systems.

Lease Terms: Before renting a commercial property in the UAE, it is important to carefully review the lease terms and conditions. This includes understanding the rental period, rent escalation clauses, security deposit, maintenance and repair obligations, and termination clauses.

Legal Considerations: The UAE has specific laws and regulations governing commercial property rentals. It is important to work with a qualified legal professional to ensure that the rental agreement is in compliance with the local laws and regulations.

In summary, renting commercial property in the UAE can provide a suitable location for your business operations. However, it is important to consider location, space requirements, rental price, amenities and facilities, lease terms, and legal considerations to ensure that you make an informed decision. -

27

Truckabuses.com wrote on 28 February 2023:

Your article is very good you have shared very good knowledge thank you

Tata ace -

28

gween wrote on 1 March 2023:

This simplistic football game does not rob you of all your money like some other style games can. It does not require wifi. No Ads. Definitely some flaws for sure but it’s very close to perfect especially if you take it for what it is. Retro Bowl Ability to play defense would be an excellent addition. Also entire league rosters/stats viewing (leader boards) would be a nice touch. Having the unlimited version is a must.

-

29

Neeraj Gupta wrote on 4 March 2023:

10 Tips for Writing Assignments in BTEC HND Business

Here are some tips to help you ace your BTEC HND Assignments:

Understand the assessment criteria: Read and understand the assessment criteria before you start working on your assignment. This will help you to know what is expected of you and ensure that you address all the necessary points.

Research thoroughly: Conduct thorough research on the topic of your assignment. Use reputable sources and ensure that the information you gather is relevant and up-to-date.

Plan your work: Create a plan for your assignment that includes a clear outline of what you want to write, how you will structure your work, and when you will complete each section. This will help you stay on track and avoid last-minute rushes.

Write clearly and concisely: Use clear and concise language to express your ideas. Ensure you answer the questions asked in the assignment and avoid going off-topic.

Use examples and case studies to support your arguments and demonstrate your understanding of the topic. This will make your work more engaging and convincing. -

30

casinocommunity wrote on 6 March 2023:

It’s too bad to check your article late. I wonder what it would be if we met a little faster. I want to exchange a little more, but please visit my site casinocommunity and leave a message!!

- 31

-

32

Massage therapist wrote on 9 March 2023:

The Massage spa Bangalore is a sanctuary of serenity and tranquility. It’s a place where you can relax, take a break, as well as disorient yourself. This treatment is a deep healing process that can also calm the mind. The Body massage in Bangalore ultimate destination to relax. Near me spa

-

33

VintageWatches.PK wrote on 9 March 2023:

vintagewatches.pk We sell Vintage Watches in Pakistan, Original Swiss Antique Watches from Pakistan, Genuine Watches Brands like Rolex, Omega, Rado, Tissot, Raymond weil, Timex, Tag-heuer, Longines, Kolber, Breitling, Bulova, Oris, Swatch, Audemars Piguet, Patek Philippe, IWC, Piaget, Zenith, Grand Seiko, Seiko Dolce, Casio G-Shock, Citizen Ana-Digi, Melody Game Calculator Watches and many many more.

-

34

LindaTurner wrote on 11 March 2023:

General rules of the good economy are studied and applied for the field work. The rate of the BOC-3 Filing

is inclined for the team. Fund is placed for the total use of the things and goods for the services. -

35

Udaipur Escort Service wrote on 13 March 2023:

Udaipur Escorts are great in thier service having sex with any of them is great decision ever..<a href=https://www.rashmika.co.in |

Udaipur Escort |

Udaipur Escort Service |

Udaipur Model Escorts |

Udaipur Female Escorts |

Udaipur Teen Escorts |

Udaipur Escorts |

Udaipur Independent Escorts |

Udaipur Actress Escorts |

Udaipur Celebrity Escorts |

Udaipur Desi Escorts | -

36

nomex coverall wrote on 15 March 2023:

Safety is first priority We have provide safety product nomex coverall protective clothing and flame-resistant is Good quality, normal fit, so kindky visit our site. thankyou.

-

37

Anita Bhatt wrote on 16 March 2023:

The Best Call Girls are available 24×7 Near You Call Girls in Chennai

-

38

Janavi Dubey wrote on 16 March 2023:

The Best Call Girls are available 24×7 Near You Call Girls in Bangalore

-

39

SelectGirls99 wrote on 16 March 2023:

The Best Call Girls are available 24×7 Near You Call Girls in Bhopal

-

40

TruckJunction wrote on 16 March 2023:

Great job on writing such an insightful and informative article! Your attention to detail and thorough research really shines through in your writing. I appreciate how you presented the information in a clear and organized manner, making it easy for readers to understand and follow along.

Euler Hi Loaad -

41

leena john wrote on 16 March 2023:

Nice knowledge gaining article. This post is really the best on this valuable topic. Trichocereus pachanoi

-

42

slotmachinesitecom wrote on 17 March 2023:

It’s wonderful that you are getting thoughts from this article as well as from our argument made at this place 바다이야기

-

43

betmantotoorg wrote on 17 March 2023:

Great article. I’m dealing with a few of these issues as well.. 스포츠토토

-

44

sportstototvcom wrote on 17 March 2023:

Amazing! Its really awesome article, I have got much clear idea regarding from this article 토토

- 45

-

46

toto365pro wrote on 17 March 2023:

토토 Simply unadulterated brilliance from you here. I have never expected something not as much as this from you.

-

47

Pooja Sharma wrote on 17 March 2023:

I’m extremely stunned Hosur Escort Services after seen your best help . be caring your data sharing you truly awesome work posting

-

48

Anjali Varma wrote on 18 March 2023:

The dazzling Delhi Call Girl will evidently draw in you to an occasion the entire evening. They will firmly make your occasion exuberant and also enchanting with amazing associations. From a genuine perspective, nothing can beat the experience of commending with our randy young ladies.

-

49

nawazchoor wrote on 18 March 2023:

This is a fantastic website and I can not recommend you guys enough. plombier bruxelles

-

50

jaban wrote on 19 March 2023:

Thanks for sharing this information. I really like your blog post very much. You have really shared a informative and interesting blog post. who is jesus

Close

Close

Very well put together in simpler terms and with interesting examples especially for readers without necessarily economics PhD background.

The ending is brilliant — Completely agree that debt, in such an unsustainable level as it is today in Mongolia’s case, can indeed be a galvanizing societal force that potentially will lead to popular uprisings, movements, and regime changes. Mongolia should brace itself for the new era of debt-ridden economics and politics.