The Mauritian Miracle

By Lisa J Walters, on 29 January 2018

By Dr Elena Nikolova, Lecturer in Economics, UCL SSEES

Both Mauritius and my hometown of Varna, Bulgaria are famous for their sandy beaches. Mauritius, for its five-star resorts on the Indian Ocean. Varna, for its breath-taking Black Sea coast. But Mauritius attracts travellers looking for luxury, while Varna (no less beautiful, by the way) – those looking for cheap sun.[1]

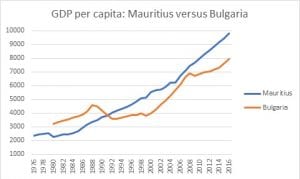

Mauritius is slightly richer than Bulgaria, but not by much. Bulgaria’s GDP per capita (in PPP terms, 2010 constant USD) in 2017 was $7, 967.70, while the corresponding figure for Mauritius is $9,822.0 (World Bank). The Mauritian government has set itself the goal of turning Mauritius in an inclusive, high-income country (with GDP per capita above $14,000) by 2030. If communist-era statistics are to be believed, Bulgaria was actually richer than Mauritius until 1990 or so. However, in recent years the gap between the two countries has widened further (Figure 1).

As of 2017, Mauritius is ranked as number 25 in the Doing Business Database, which measures the ease of doing business in a country based on indicators such as how easy it is to get electricity or resolve insolvency (as a comparison, France’s ranking is 31, behind Mauritius). By comparison, Bulgaria’s ranking is 50. Mauritius is also less corrupt than Bulgaria. Transparency International ranks Mauritius as the 50th least corrupt country in the world, while Bulgaria occupies 75th place (this comparison is based on data from 2016). And, Mauritius is a much happier place than Bulgaria: Mauritius is ranked as the 64th happiest country in the world, while Bulgaria’s ranking is 105 (out of 155 countries, 2017 World Happiness Report).

Figure 1:

Close

Close