The BRITS team’s analysis of the 592 commercial cell therapy projects that were identified highlights that the cell therapy sector is a sector that spans all key therapeutic application areas. A breakdown in figure 4 of the therapeutic focus of cell therapy projects highlights that oncology constitutes the largest area in which new cell therapies are being developed as 26.2% of cell therapy projects are in the oncology space. Oncology is followed by neurology (15.4%), alimentary/metabolic (13.4%), cardiovascular (11.3%), and musculoskeletal as the largest therapeutic markets cell therapy projects are directed at.

Figure 4: Cell therapy projects by therapeutic focus

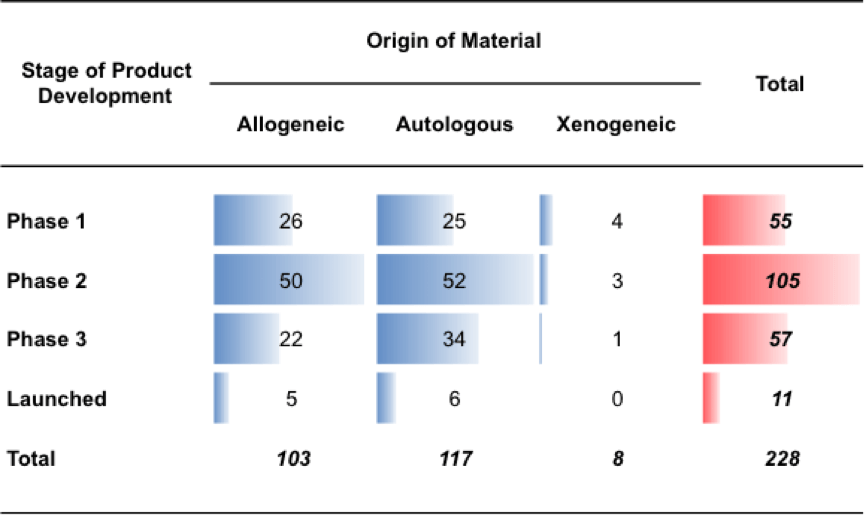

Figure 5 breaks down the 593 commercial cell therapy projects the BRITS team collected data on, by the stage of development. Figure 5 highlights that most (364) cell therapy projects did not progress beyond pre-clinical trials. 55 reached stage 1 clinical trials, 105 reached stage 2 clinical trials, and 57 reached stage 3 clinical trials. Finally, the BRITS team identified 11 cell therapy projects that reached the market.

Figure 5: Cell therapy companies, projects by stage of development

A unique aspect of the dataset of cell therapy projects the BRITS team created is that it contains information on both discontinued and on-going cell therapy projects. This has allowed the BRITS team for example to provide assessments of the likelihood of failure for specific types of cell projects. Figure 6 breaks down the number of discontinued and on-going projects that data were collected on.

Figure 6: On-going/discontinued cell therapy projects by therapeutic focus

Close

Close